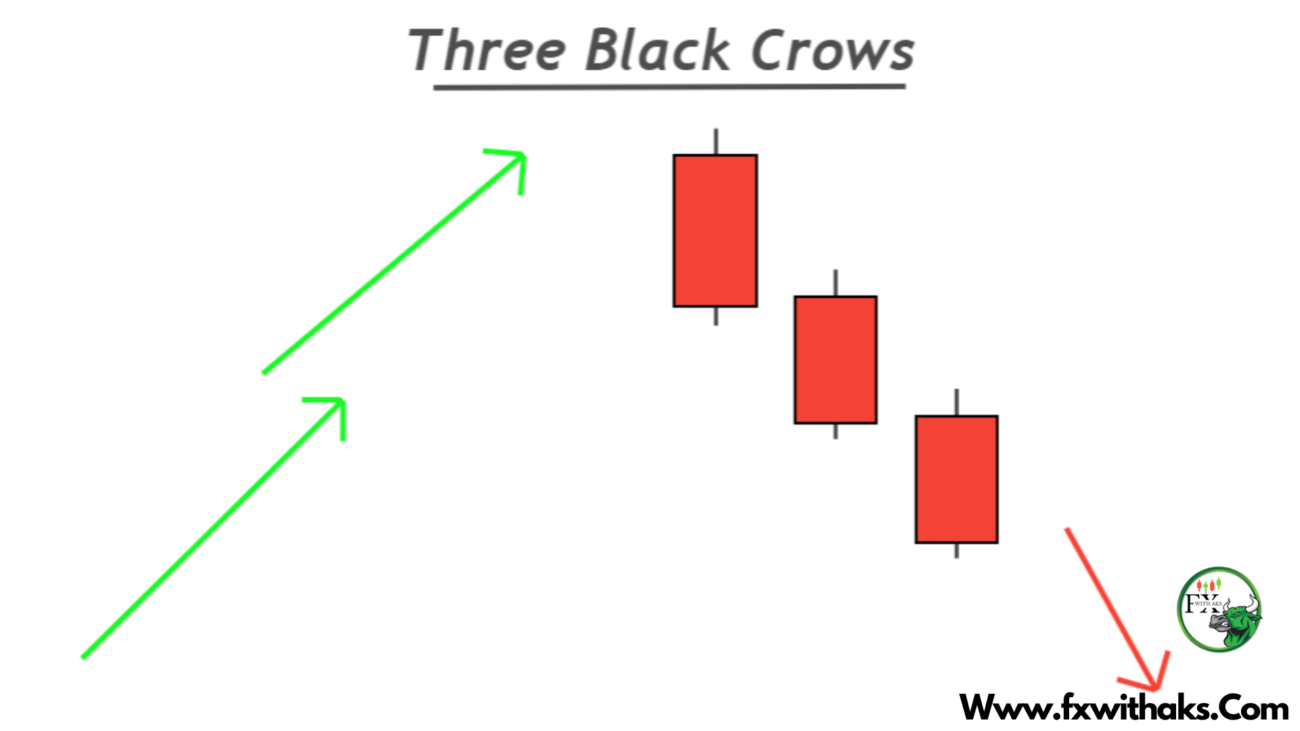

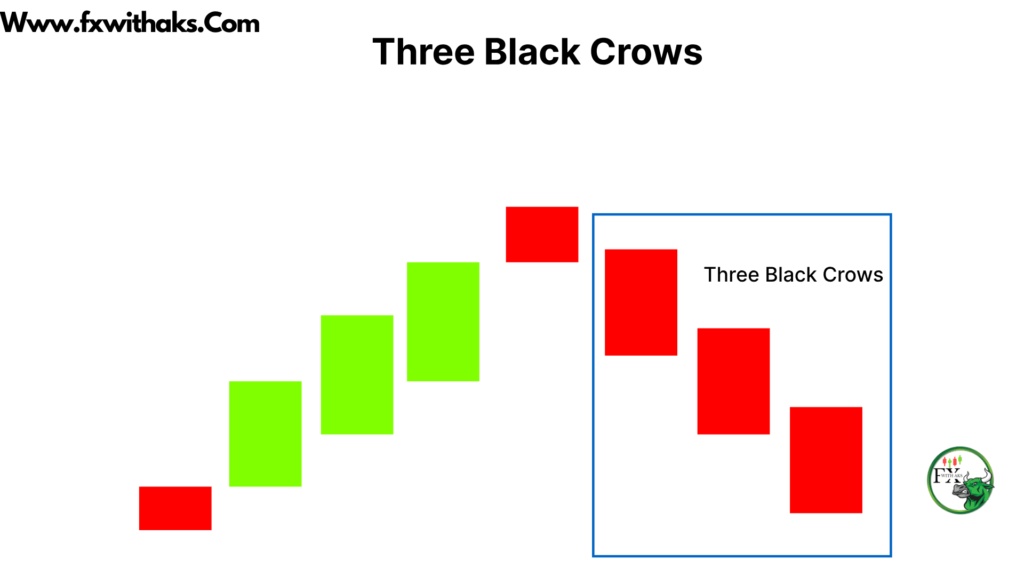

The Three Black Crows is a strong bearish reversal candlestick pattern that signals a potential end of an uptrend and the start of a downtrend.

🪶 What is the Three Black Crows Pattern?

🔍 Pattern Characteristics:

- Appears after an uptrend or at the top of a bullish move

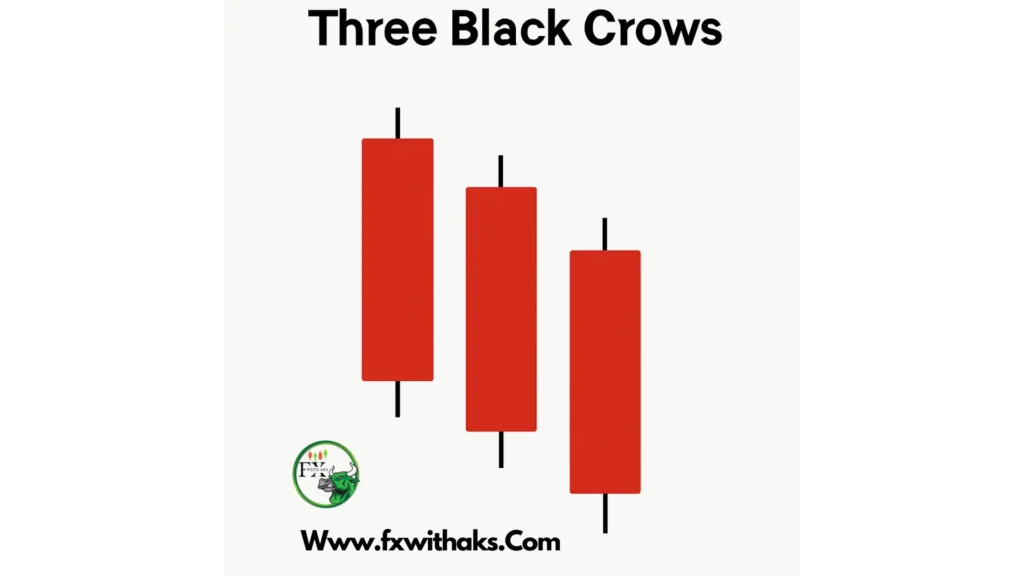

- Consists of three consecutive bearish candles

- Each candle:

- Has a long real body

- Opens within the body of the previous candle

- Closes lower than the previous candle

- Has little to no lower wick (showing strong selling pressure)

📉 What It Means

- Momentum has shifted from bulls to bears

- Selling pressure is consistent over 3 sessions

- Signals strong potential reversal to the downside

🛠️ How to Trade the Three Black Crows

1. Identify the Pattern

- Must appear after a clear uptrend

- The three bearish candles should be relatively similar in size

- Smaller or no lower shadows = stronger signal

2. Confirm the Signal

Before jumping in, confirm with: ✅ High volume on the pattern

✅ Overbought conditions on RSI or Stochastic

✅ Pattern forming near resistance

✅ Bearish crossover on MACD

3. Entry Point

📌 Aggressive Entry:

Go short at the close of the third candle

📌 Conservative Entry:

Wait for a break below the low of the third candle, or a bearish follow-through candle

4. Stop Loss Placement

🛑 Set your stop loss:

- Just above the high of the first candle in the pattern

- Or above the most recent resistance level

5. Take-Profit Targets

🎯 Aim for:

- Recent support levels

- Measured moves or swing lows

- Favor a risk-reward ratio of at least 1:2

🧠 Pro Tips:

- Most effective on higher timeframes (1H, 4H, Daily)

- Stronger when part of a confluence zone (resistance, fib level, etc.)

- Combine with trendlines, moving averages, or oscillators for added confirmation

Want a chart visual or trading example of the Three Black Crows in action?