Uptrend Trading Strategy in Forex (Price Action Guide)

Uptrend trading is one of the most reliable and profitable approaches in forex trading when done correctly. Professional traders always prefer to trade with the trend, and an uptrend offers clear buying opportunities with higher probability.

In this guide, you’ll learn what an uptrend is, how to identify it, and how to trade it using pure price action.

What Is an Uptrend?

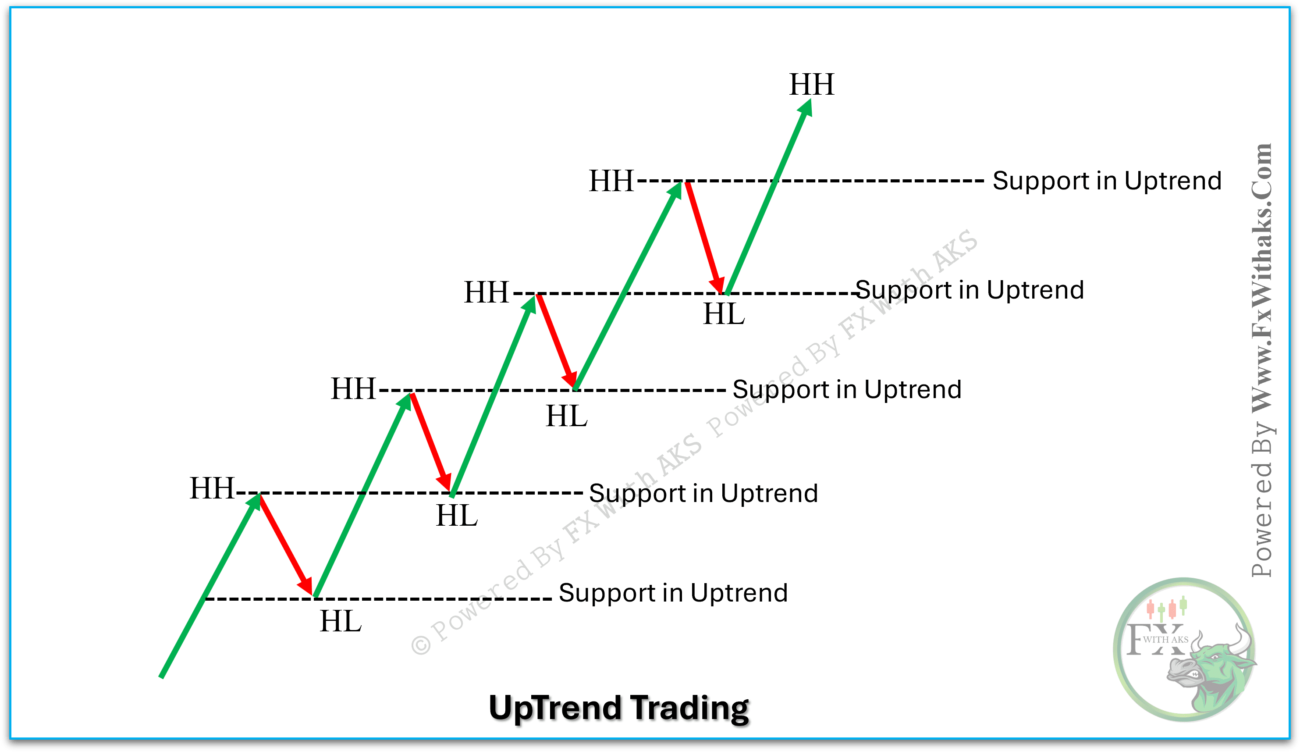

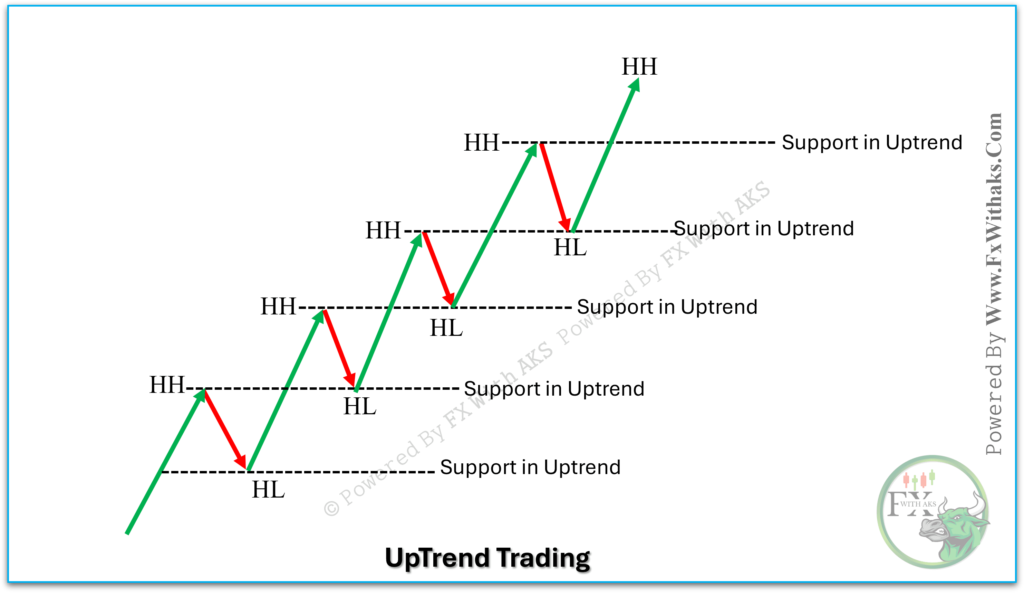

An uptrend occurs when the market consistently makes:

- Higher Highs (HH)

- Higher Lows (HL)

This structure shows that buyers (bulls) are in control and price is moving upward over time.

👉 Golden rule:

Never sell in an uptrend. Look for buy opportunities only.

How to Identify an Uptrend

You can identify an uptrend using market structure, not indicators.

Key Characteristics:

✔ Higher highs

✔ Higher lows

✔ Price respects support levels

✔ Pullbacks are shallow and controlled

Simple Method:

- Mark recent highs and lows

- If each new high is higher than the previous one

- And each new low is higher than the previous low

➡ The market is in an uptrend

Best Timeframes for Uptrend Trading

- Higher Timeframes (HTF): H4, Daily → Identify the main trend

- Lower Timeframes (LTF): M15, M30, H1 → Find entry opportunities

📌 Always trade in the direction of the higher timeframe trend.

Uptrend Trading Strategies (Price Action)

1. Buy on Pullbacks (Best Strategy)

This is the most effective and safest uptrend strategy.

Steps:

- Identify an uptrend (HH & HL)

- Wait for price to pull back

- Enter buy near:

- Previous higher low

- Support zone

- Trendline support

📍 Entry: After bullish confirmation candle

📍 Stop Loss: Below the higher low

📍 Take Profit: At next higher high or resistance

2. Trendline Uptrend Strategy

Trendlines help visualize trend direction.

How to draw:

- Connect at least two higher lows

- Price should respect the trendline

Trading method:

- Buy when price touches the trendline

- Confirm with bullish candlestick pattern

⚠ Avoid forcing trendlines — clarity matters.

3. Breakout & Retest in Uptrend

Strong uptrends often break resistance levels.

Steps:

- Price breaks resistance

- Resistance becomes support

- Enter buy on retest

This works extremely well in strong trending markets.

Best Candlestick Patterns for Uptrend Trading

Look for bullish price action patterns at support areas:

- Bullish Engulfing

- Pin Bar (Bullish rejection)

- Inside Bar breakout

- Strong bullish close

📌 Patterns work best only when aligned with trend.

Risk Management in Uptrend Trading

No strategy works without proper risk control.

Rules:

- Risk 1–2% per trade

- Use fixed stop loss

- Maintain 1:2 or higher risk-reward

- Avoid overtrading

💡 Consistency > Big profits.

Common Mistakes Traders Make

❌ Selling in an uptrend

❌ Chasing price at highs

❌ Ignoring higher timeframe trend

❌ Overusing indicators

❌ No stop loss

Avoiding these mistakes alone can improve your results significantly.

Indicators (Optional – Not Required)

Uptrend trading works best without indicators, but if needed:

- Moving Average (trend direction only)

- RSI (trend confirmation, not entry)

⚠ Do not rely on indicators alone.

Final Thoughts

Uptrend trading is simple, powerful, and effective when you:

- Follow market structure

- Trade pullbacks, not breakouts blindly

- Use strict risk management

- Stay patient and disciplined

👉 Remember:

The trend is your friend — until it ends.

🔧 Useful Tools & Indicators

| Tool/Indicator | Use |

|---|---|

| Moving Averages (MA/EMA) | Trend direction and support |

| RSI | Overbought/oversold levels |

| MACD | Trend strength and momentum |

| Volume | Confirm price movement |

| Trendlines | Support and resistance |

Ready to Trade Smarter?

Explore more price action strategies, forex tools, and professional trading guides only on FXWithAKS.com.