Here’s a Complete Guide to Candlestick Patterns, categorized into bullish, bearish, and continuation patterns. These patterns help traders analyze market sentiment and predict future price movements.

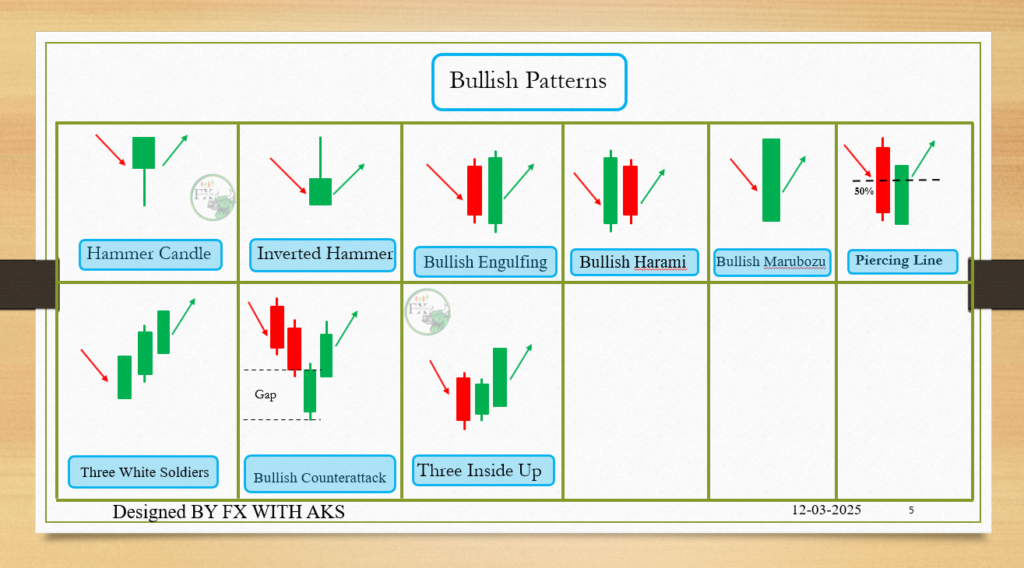

1. Bullish Reversal Patterns (Indicate a potential trend reversal from downtrend to uptrend)

a) Single-Candle Patterns

- Hammer 🛠️ – A small body with a long lower wick, signaling a potential reversal after a downtrend.

- Inverted Hammer – Similar to a hammer but with a long upper wick, suggesting a reversal.

- Doji – A candle with a tiny or non-existent body, indicating indecision but potential reversal when at the bottom of a trend.

b) Multi-Candle Patterns

- Bullish Engulfing – A large bullish candle engulfs the previous bearish candle, signaling strong buying pressure.

- Piercing Line – A two-candle pattern where the second bullish candle closes above the midpoint of the previous bearish candle.

- Morning Star – A three-candle pattern with a bearish candle, a small indecisive candle (doji/spinning top), and a strong bullish candle.

- Three White Soldiers – Three consecutive bullish candles, each closing higher, indicating strong bullish momentum.

2. Bearish Reversal Patterns (Indicate a potential trend reversal from uptrend to downtrend)

a) Single-Candle Patterns

- Shooting Star ⭐ – A small-bodied candle with a long upper wick, signaling a potential bearish reversal.

- Gravestone Doji – Similar to a shooting star, but with an almost non-existent body, indicating strong rejection of higher prices.

b) Multi-Candle Patterns

- Bearish Engulfing – A large bearish candle engulfs the previous bullish candle, showing strong selling pressure.

- Dark Cloud Cover – A two-candle pattern where the second bearish candle closes below the midpoint of the previous bullish candle.

- Evening Star – A three-candle pattern with a bullish candle, a small doji/spinning top, and a strong bearish candle.

- Three Black Crows – Three consecutive bearish candles, each closing lower, signaling strong bearish momentum.

3. Continuation Patterns (Indicate trend continuation rather than reversal)

a) Indecision Candles

- Spinning Top – A small body with long upper and lower wicks, indicating market indecision.

- Doji Variants (Standard, Long-Legged, Dragonfly, Gravestone) – Indicate hesitation in the market.

b) Multi-Candle Continuation Patterns

- Rising Three Methods – A large bullish candle, followed by three smaller bearish candles, then another strong bullish candle.

- Falling Three Methods – A large bearish candle, followed by three smaller bullish candles, then another strong bearish candle.

- Mat Hold – A variation of the “Three Methods” pattern, signaling a continuation.

How to Use Candlestick Patterns in Trading

- Confirm with Indicators – Use RSI, MACD, moving averages, or Bollinger Bands to strengthen signals.

- Check Volume – Higher volume during pattern formation increases its reliability.

- Identify Key Levels – Look for support/resistance levels to validate patterns.

- Avoid False Signals – Wait for confirmation rather than trading immediately.

BY FX WITH AKS –

40 Powerful Candlestick Patterns: A Complete Trading Guide for Beginner Traders

📈 Bullish Candlestick Patterns

- Hammer

- Inverted Hammer

- Bullish Engulfing

- Piercing Line

- Morning Star

- Three White Soldiers

- Bullish Harami

- Tweezer Bottom

- Bullish Counterattack

- Bullish Marubozu

- Dragonfly Doji

- Bullish Kicker

- Rising Three Methods

- Bullish Abandoned Baby

📉 Bearish Candlestick Patterns

- Hanging Man

- Shooting Star

- Bearish Engulfing

- Dark Cloud Cover

- Evening Star

- Three Black Crows

- Bearish Harami

- Tweezer Top

- Bearish Counterattack

- Bearish Marubozu

- Gravestone Doji

- Bearish Kicker

- Falling Three Methods

- Bearish Abandoned Baby

🔄 Continuation / Neutral Patterns

- Doji

- Long-Legged Doji

- Spinning Top

- Four Price Doji

- Inside Bar

- Outside Bar

- Side-by-Side White Lines

- Upside Tasuki Gap

- Downside Tasuki Gap

- Mat Hold Pattern

- High Wave Candle

- Rickshaw Man

Very good 👌