The Dark Cloud Cover is a classic bearish reversal candlestick pattern that signals a potential shift from an uptrend to a downtrend. It’s like a warning that the bullish party might be over.

🌩️ What is a Dark Cloud Cover?

🔍 Pattern Characteristics:

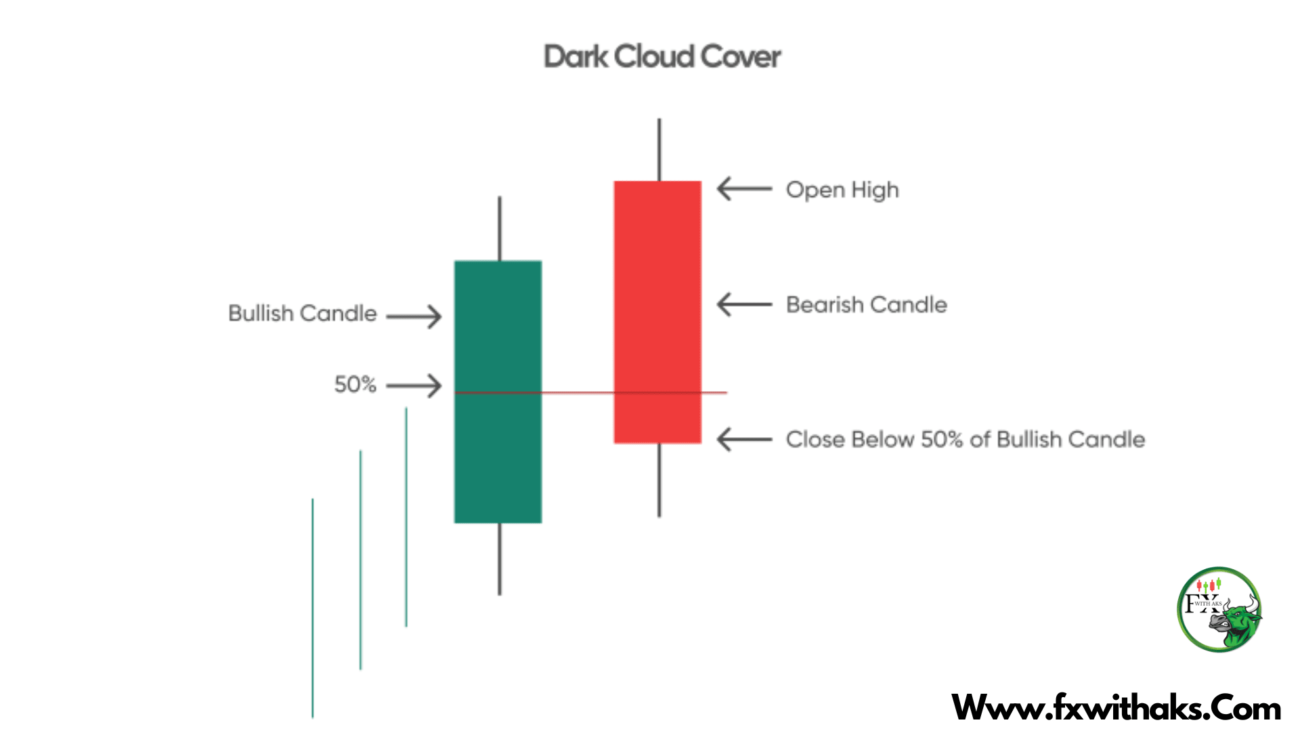

- Appears after an uptrend

- First candle is a strong bullish candle (green/white)

- Second candle is bearish (red/black) that:

- Opens above the high of the previous candle (gap up)

- Closes below the midpoint of the first candle

This shows that buyers tried to push higher, but sellers came in strong and reversed the momentum.

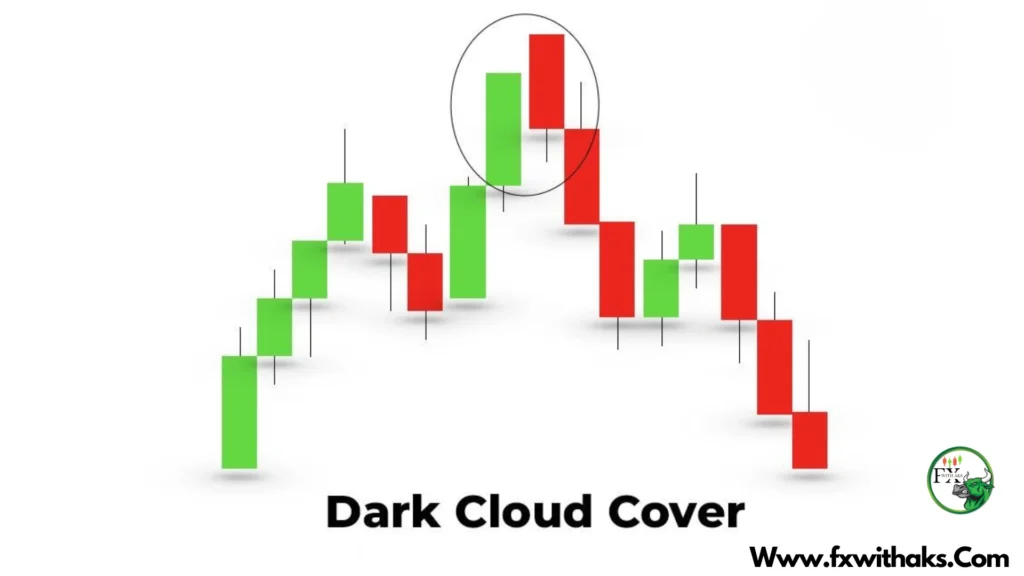

🔻 What It Tells You

- Bullish momentum is fading

- Sellers are taking control

- A potential trend reversal could follow

📉 How to Trade the Dark Cloud Cover

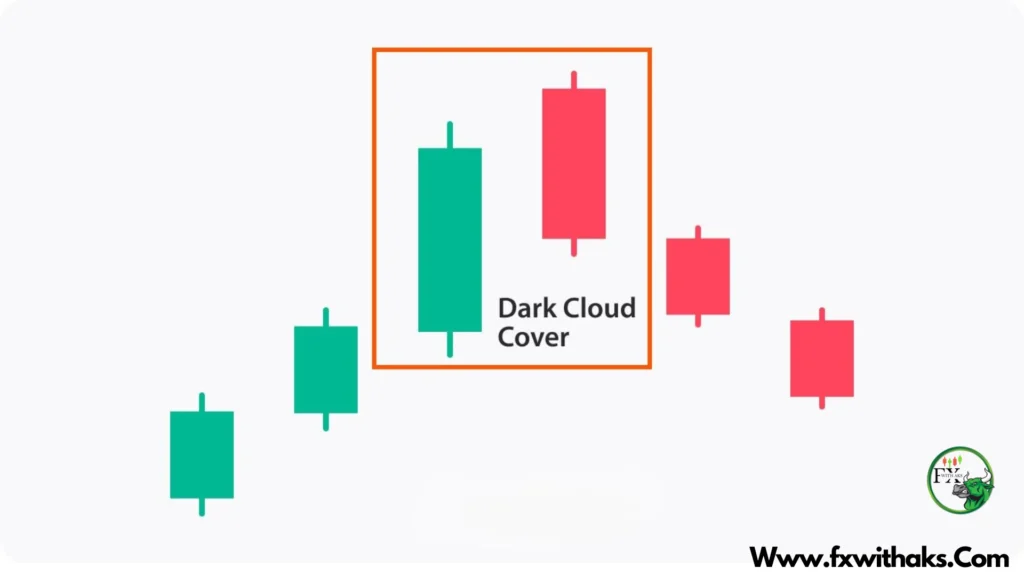

1. Identify the Setup

- Occurs after a solid uptrend or rally

- Pattern must match the structure above

- Stronger if near a resistance level or Fibonacci zone

2. Confirm the Pattern

Use confirmation before entering a trade:

✅ Next candle closes lower

✅ Volume spike on the bearish candle

✅ Bearish signals from RSI, MACD, or Stochastic

✅ Price fails to break above recent highs

3. Entry Point

📌 Aggressive Entry:

Enter short at the close of the Dark Cloud Cover candle

📌 Conservative Entry:

Wait for the next candle to break the low of the Dark Cloud candle

4. Stop Loss

🛑 Place your stop loss:

- Just above the high of the pattern

- Or just above a nearby resistance level

5. Profit Targets

🎯 Set targets based on:

- Nearest support levels

- Trendlines or previous swing lows

- Use a 1:2 or better risk-to-reward ratio

🧠 Pro Tips:

- Combine with other tools like trendlines, moving averages, or volume analysis

- Avoid in sideways/choppy markets

- Best on higher timeframes (1H, 4H, Daily) for reliable setups

Want me to generate a chart example or visual for the Dark Cloud Cover?