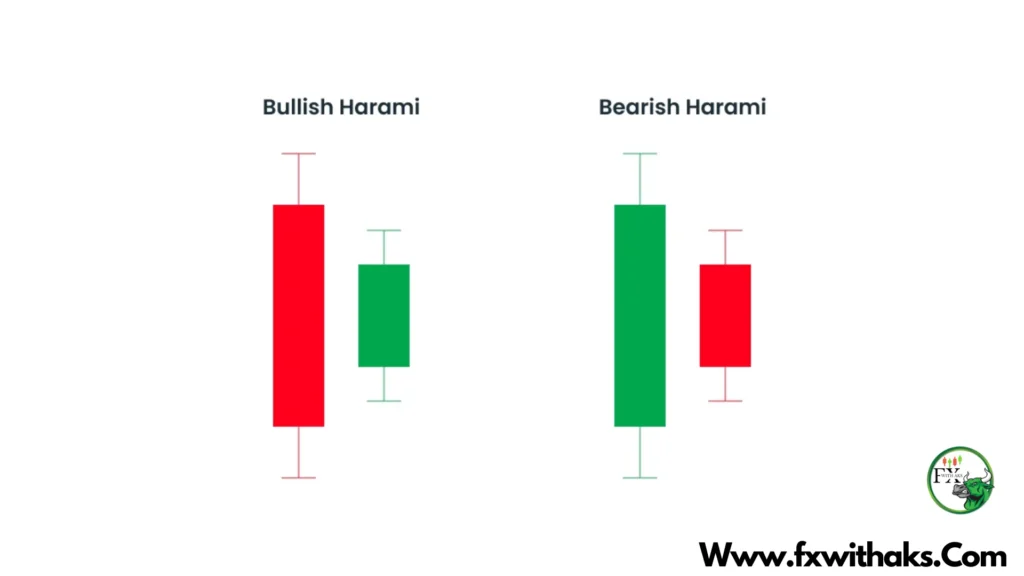

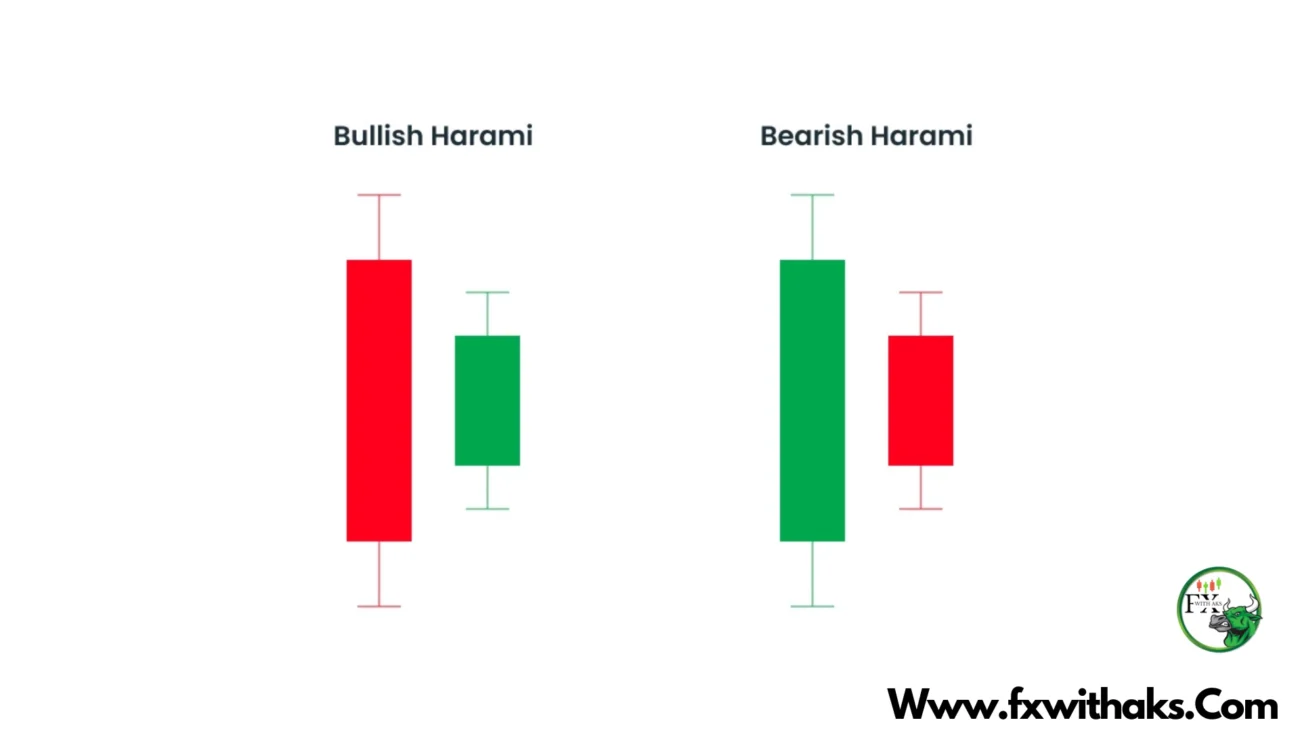

A Bearish Harami is a two-candle chart pattern used in technical analysis, commonly seen as a potential reversal signal from a bullish trend to a bearish one. It gets its name from the Japanese word “harami,” meaning “pregnant,” as the pattern visually resembles a smaller candlestick “inside” a larger one.

📉 Bearish Harami Pattern Breakdown:

- First Candle (Bullish):

- Long green (or white) candlestick.

- Indicates strong upward momentum.

- Second Candle (Bearish or Doji):

- Small red (or black) candlestick.

- Completely contained within the body of the first candle.

- It can be bearish or a doji (indicating indecision).

🔍 Key Characteristics:

- The second candle does not need to close lower than the first, just inside the body.

- It suggests that buying pressure is weakening.

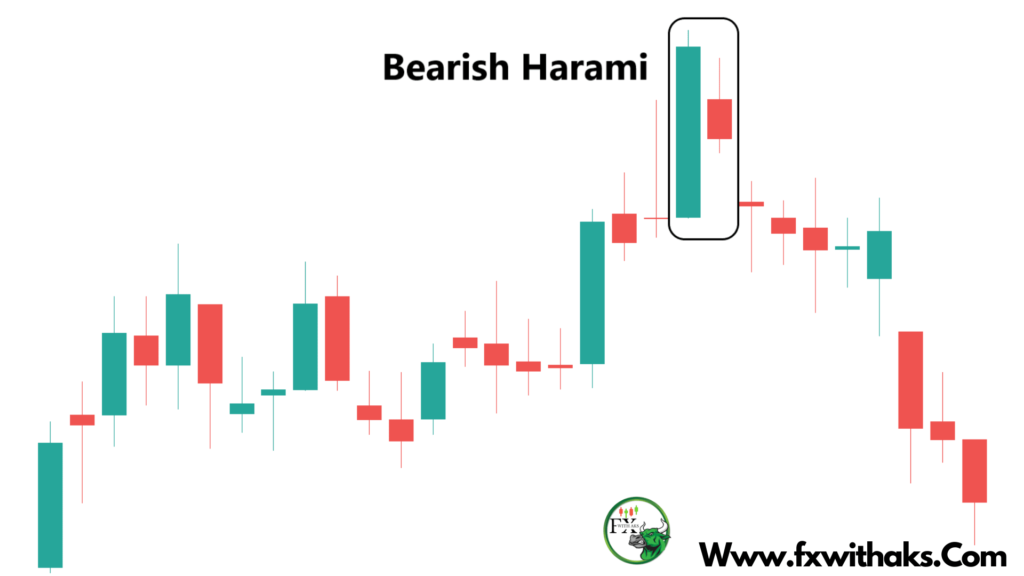

- More reliable when it appears after a strong uptrend.

✅ Confirmation:

To increase reliability, traders usually wait for a third candle that confirms the bearish move — like a red candle that closes lower than the second candle.

📊 Example:

Let’s say you see this on a chart:

- Day 1: Big green candle, price moves from $100 to $110.

- Day 2: Small red candle, price opens at $109 and closes at $107.

This could be a Bearish Harami — a warning that the uptrend may be losing steam.

Want me to show you an example chart or code to detect it automatically in a dataset?

Trading with a Bearish Harami pattern is all about recognizing the potential shift in momentum and managing your risk wisely. Here’s a step-by-step guide you can follow:

📉 How to Trade a Bearish Harami Pattern

1. Identify the Pattern

Make sure the conditions are met:

- There’s a clear uptrend before the pattern.

- The first candle is large and bullish.

- The second candle is small and bearish (or a doji), and its body is completely within the first candle’s body.

2. Wait for Confirmation

A common mistake is entering too early. Look for:

- A third candle that closes below the second candle.

- Increased volume can strengthen confirmation.

- You can also use technical indicators like RSI or MACD to confirm overbought conditions.

✅ Entry Signal:

- Enter a short position (or sell) once the price breaks below the second candle’s low.

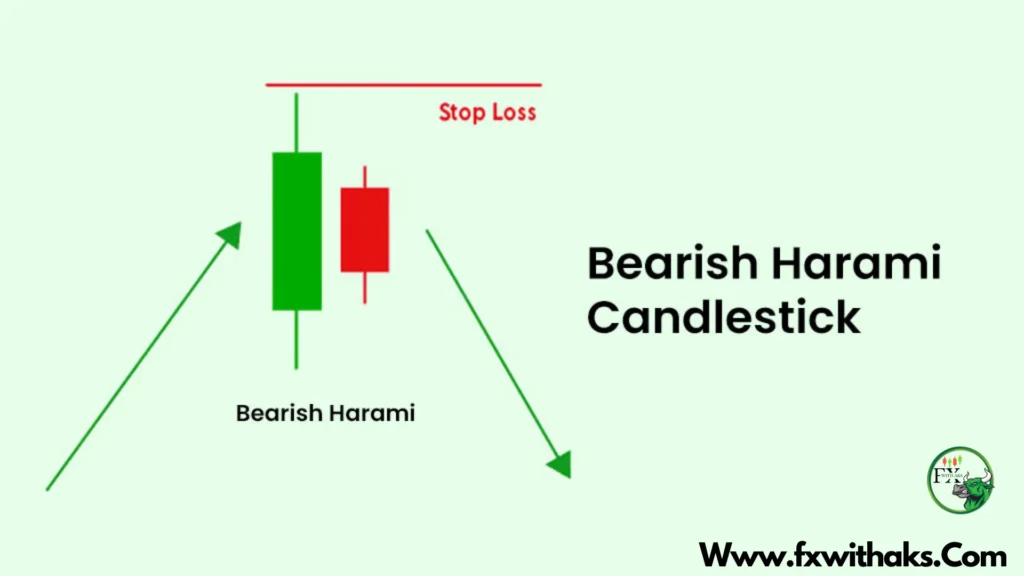

3. Set a Stop Loss

Protect yourself from false signals.

🔒 Where to place it:

- Just above the high of the first (bullish) candle.

4. Set a Profit Target

Aim for a reward-to-risk ratio of at least 2:1.

🎯 Options:

- Use support levels to decide your exit.

- Or use a trailing stop to follow the price downward.

5. Optional: Use with Other Indicators

- RSI: Overbought (above 70) supports bearish bias.

- MACD: A bearish crossover adds confidence.

- Volume: Low volume on the second candle + higher volume on the breakdown = stronger signal.

📌 Example Trade Setup

| Action | Price Level |

|---|---|

| Entry | Below 2nd candle’s low |

| Stop Loss | Above 1st candle’s high |

| Take Profit | Nearest support / 2x risk |

Would you like:

- A visual example/chart?

- Code to scan for this pattern in a dataset?

- Or examples from current stock charts?

One thought on “Bearish Harami Candle – Definition , How To Trade”