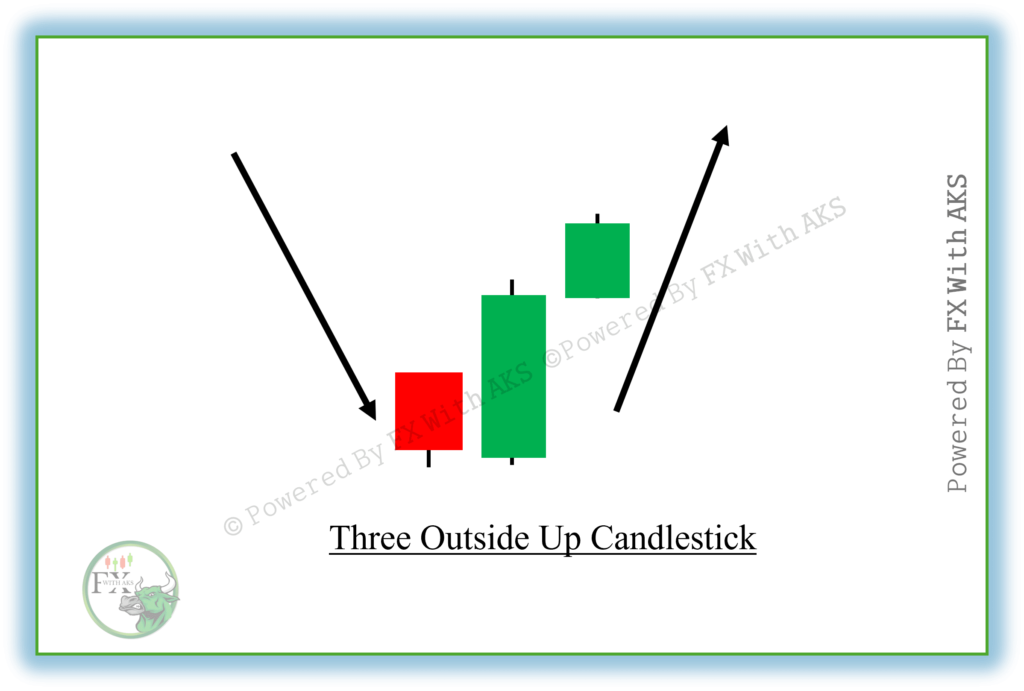

The Three Outside Up candlestick pattern is a bullish reversal pattern that typically appears after a downtrend. It signals a potential shift from bearish to bullish momentum and consists of three candlesticks.

🔺 Three Outside Up (Bullish Reversal)

✅ Structure:

- First Candle: Bearish (red), shows the current downtrend

- Second Candle: Bullish engulfing candle – it fully engulfs the first candle’s body

- Third Candle: Another bullish candle closing higher than the second candle

🔍 Meaning:

- First candle shows the existing selling trend

- Second candle signals a strong shift in sentiment (bullish engulfing)

- Third candle confirms the reversal with follow-through buying

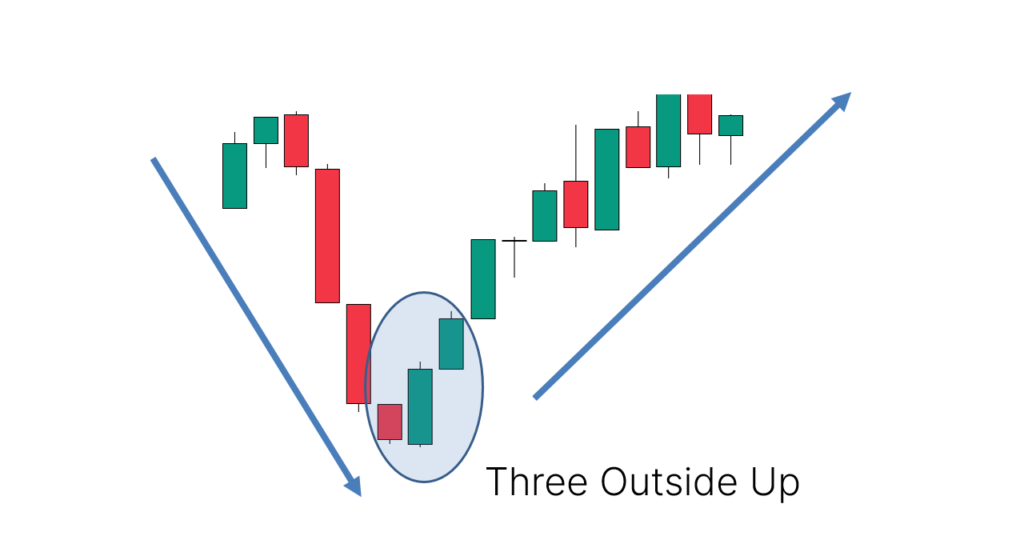

📈 Use Case:

- Appears at the end of a downtrend

- Signals a bullish reversal

- Stronger if occurs near a support zone

🎯 Trading Strategy:

- Entry: At the close of the third candle, or break above its high

- Stop-Loss: Below the low of the first candle

- Target: Nearby resistance or Fibonacci level

🔻 Three Outside Down (Bearish Reversal)

✅ Structure:

- First Candle: Bullish (green), shows the current uptrend

- Second Candle: Bearish engulfing – fully engulfs the first candle’s body

- Third Candle: Another bearish candle closing lower than the second candle

🔍 Meaning:

- First candle continues the existing bullish trend

- Second candle shows a strong shift to bearish control

- Third candle confirms the reversal with continued selling

📉 Use Case:

- Appears at the top of an uptrend

- Signals a bearish reversal

- Stronger if it forms near resistance

🎯 Trading Strategy:

- Entry: At the close of the third candle, or break below its low

- Stop-Loss: Above the high of the first candle

- Target: Next support level or a measured move

🧠 Pro Tips

- Use volume confirmation: higher volume on second or third candle is more convincing

- Combine with trendline breaks or oscillator divergence

- Look for patterns on H1, H4, or daily timeframes for stronger signals

Best EMA for Trading – Simple & Practical Guide for Traders

EMA (Exponential Moving Average) reacts faster to price than a normal moving average, which makes…

Risk-On / Risk-Off Meter – Real Time Market Sentiment

A Real-Time Snapshot of Global Market SentimentFinancial markets constantly rotate between Risk-On and Risk-Off conditions….

Forex Poster Maker -Accurate Forex Buy/Sell Signals

Create professional forex posters instantly! Get precise buy/sell signals for major currency pairs, crypto, metals,…

Free Forex Profit/Loss Calculator | Accurate Pips & pl Calculation

A precise profitability tool designed for business owners and analysts. Enter revenue, COGS, fixed/variable costs,…

Gold Price Seasonality Chart 10 Year XAU/USD

XAUUSD Gold Seasonality Bar Chart (Last 10 Years) Gold (XAUUSD) – 10-Year Seasonality Gold Price…

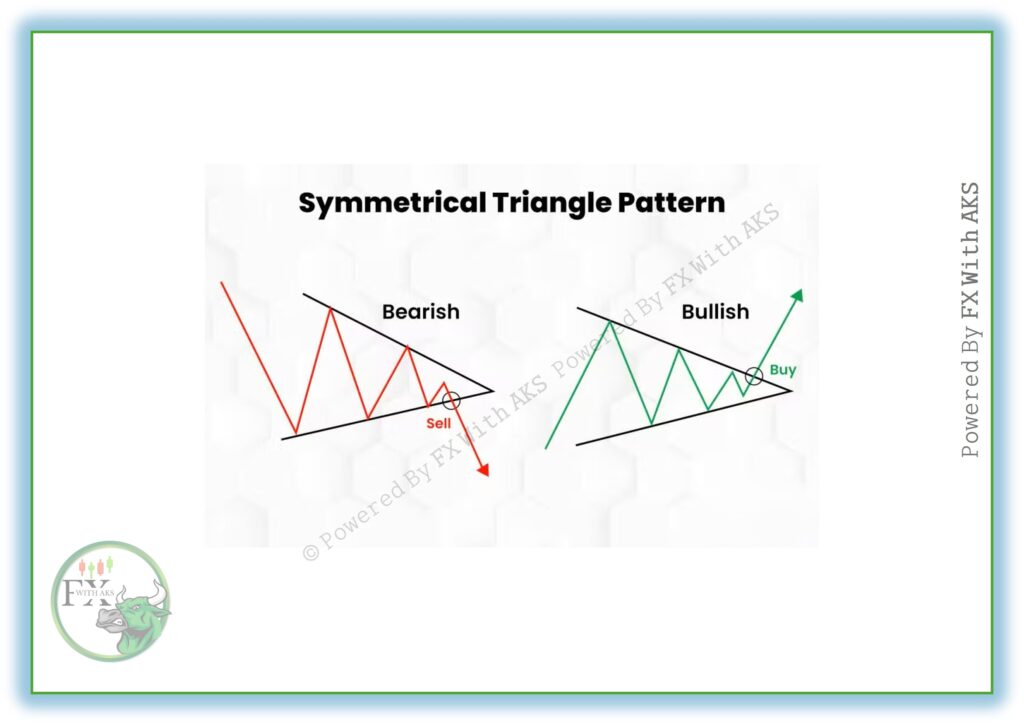

Symmetrical Triangle Pattern in Trading – How to Trade Breakouts | FXWithAKS

A Symmetrical Triangle is a chart pattern that appears when the market is consolidating, and…