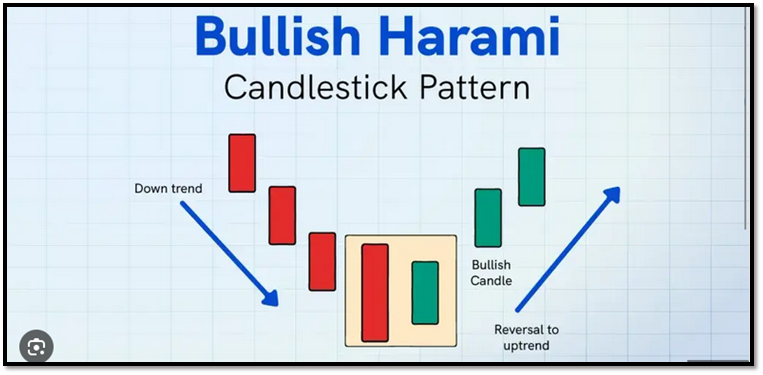

The Bullish Harami is a two-candlestick pattern that suggests a potential reversal from a downtrend to an uptrend.

It is considered a bullish signal in technical analysis and often appears at the bottom of a downtrend.

Characteristics of a Bullish Harami:

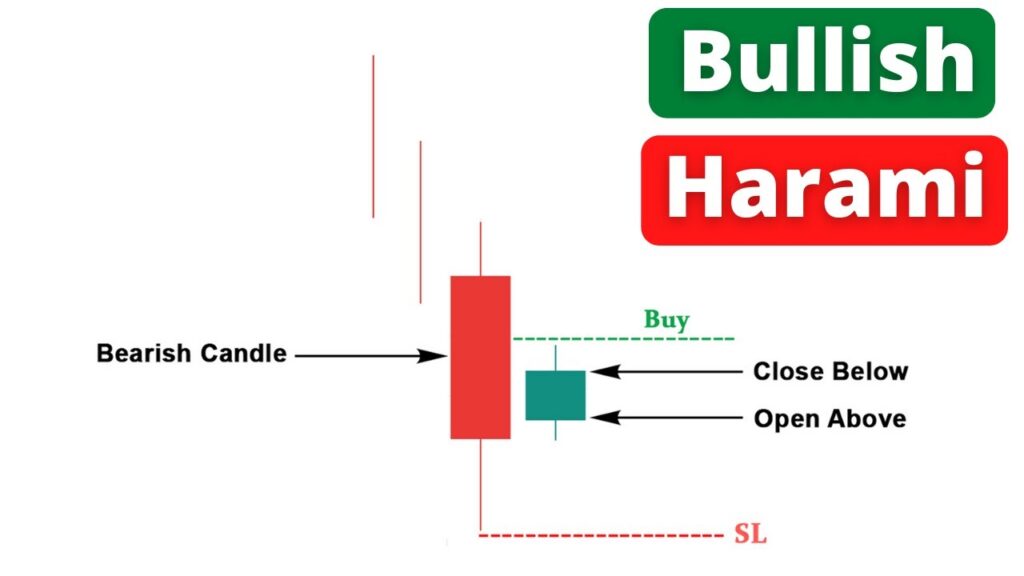

- First Candle (Bearish): A large red (bearish) candlestick that continues the current downtrend.

- Second Candle (Bullish): A small green (bullish) candlestick that is completely within the body of the previous red candle.

- Gap or No New Low: The second candle opens higher than the previous close (or very close to it) and remains small, indicating a slowdown in selling pressure.

Meaning & Psychology Behind the Pattern:

- The large bearish candle suggests strong selling pressure.

- The small bullish candle within the previous candle’s range indicates that selling momentum is weakening.

- If followed by a confirmation candle (a bullish close after the pattern), it suggests that buyers are stepping in.

Trading Strategy:

- Entry: Traders usually wait for confirmation with a bullish candle after the pattern.

- Stop-Loss: Placed below the low of the pattern.

- Target: Can be set at previous resistance levels or based on risk-reward ratio.

Would you like a visual representation or more details on how to use it in trading strategies?

One thought on “How To Trade Bullish Harami Candlestick”