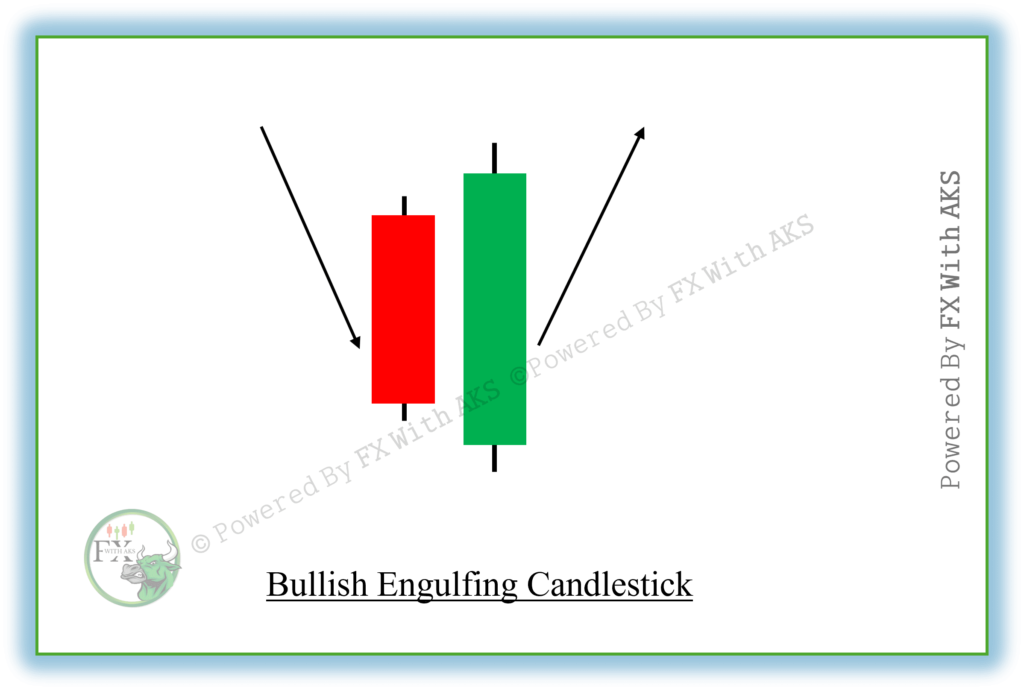

The Bullish Engulfing pattern is a strong bullish reversal pattern that appears after a downtrend, signaling a potential shift in market sentiment from bearish to bullish.

Bullish Engulfing Pattern : Definition Formation In Trading

Key Characteristics of a Bullish Engulfing Pattern:

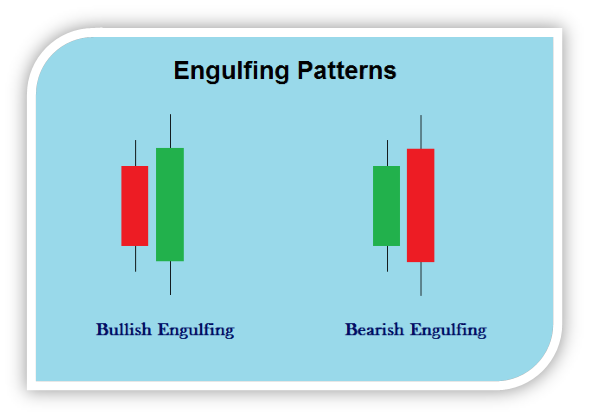

- Two Candlestick Pattern – It consists of two candles:

- The first candle is bearish (red) and relatively small.

- The second candle is bullish (green) and significantly larger.

- Full Engulfing – The body of the second candle completely engulfs the body of the first candle.

- Appears After a Downtrend – It forms at the bottom of a downtrend, signaling a reversal.

- The Close is Higher Than the Open of the First Candle – Showing strong buying pressure.

What the Bullish Engulfing Pattern Signals:

- The first bearish candle shows selling pressure.

- The second, much larger bullish candle signals strong buying momentum, overpowering the sellers.

- If confirmed by the next candle closing higher, it indicates a potential trend reversal.

How to Trade the Bullish Engulfing Pattern:

Trading the Bullish Engulfing pattern can be a high-probability strategy when used with proper context and confirmation. Here’s how to trade it effectively:

📈 What is a Bullish Engulfing Pattern?

A Bullish Engulfing is a two-candle pattern that signals potential reversal from bearish to bullish.

🔍 Pattern Characteristics:

- Appears after a downtrend or pullback.

- The first candle is bearish (small red/black).

- The second candle is bullish (large green/white) and completely engulfs the first candle’s body.

- Shows a strong shift in momentum from sellers to buyers.

✅ How to Trade the Bullish Engulfing Pattern

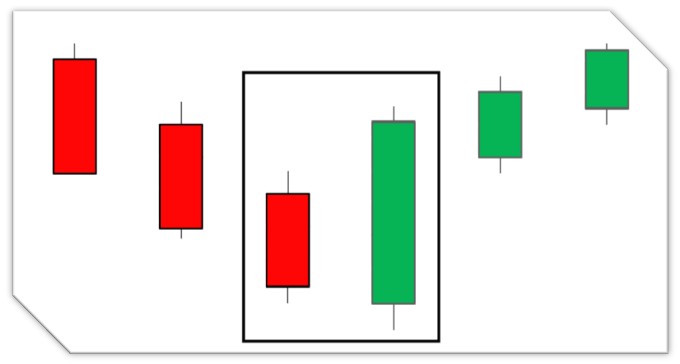

1. Identify the Pattern

Look for the two-candle formation:

- After a downtrend or consolidation

- Second candle’s body fully engulfs the first candle’s body

2. Add Confirmation

Use these tools to confirm the strength of the pattern:

✔️ Volume: Higher volume on the second candle = stronger signal

✔️ Support zone: Pattern forms at or near a key support level

✔️ Indicators: Bullish divergence on RSI, Stochastic, MACD crossover

✔️ Follow-up candle: Next candle closes higher to confirm bullish momentum

3. Entry Point

📌 Aggressive Entry:

Enter at the close of the bullish engulfing candle

📌 Conservative Entry:

Wait for the next candle to break above the high of the engulfing candle

4. Stop Loss Placement

🛑 Place your stop loss:

- Just below the low of the engulfing pattern

- Or below a nearby support level if it’s tighter

5. Profit Targets

🎯 Set targets based on:

- Previous resistance levels

- Fibonacci retracement levels

- Risk:Reward ratio (aim for 1:2 or better)

🧠 Bonus Trading Tips:

- Works best on higher timeframes (1H, 4H, Daily) for more reliable signals

- Look for patterns at key support zones

- Combine with trendlines or moving averages to strengthen setups

Want a chart example or visual breakdown of the setup?

One thought on “Bullish Engulfing Candle Pattern – How To Trade”