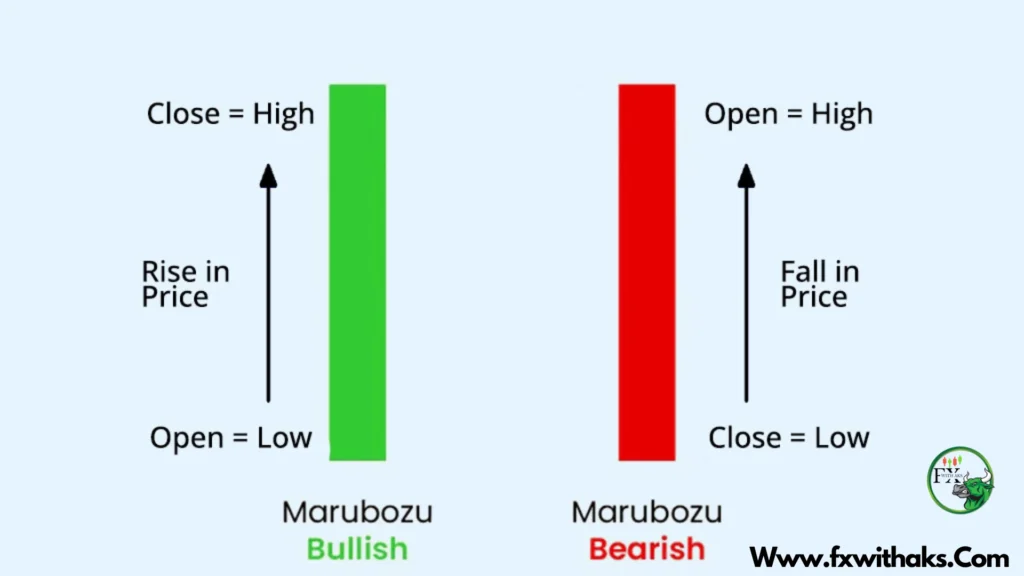

A Bearish Marubozu is a type of candlestick pattern in technical analysis that signals strong selling pressure and can indicate the start of a downtrend or continuation of a bearish move.

Key Characteristics:

- Long red (black) body: The candle opens at the high and closes at the low of the session.

- No wicks (or very small ones): There are no upper or lower shadows, which means sellers were in control from start to finish.

- Appears after an uptrend or during a downtrend.

What It Indicates:

- Strong bearish sentiment — Sellers dominated the session.

- If it appears after an uptrend, it can signal a potential trend reversal.

- If it forms during a downtrend, it can suggest continuation of the bearish momentum.

Example Chart Interpretation:

If you see a Bearish Marubozu on a chart:

- Consider it a warning of further downside.

- Look for confirmation from the next candlesticks or other indicators (like volume or RSI).

- Conservative traders wait for confirmation before taking action.

Want me to generate a visual of this pattern for you?

Trading with a Bearish Marubozu candlestick can be powerful, especially when used with proper confirmation and risk management. Here’s a simple guide to help you trade it effectively:

🔻 How to Trade a Bearish Marubozu

1. Identify the Pattern

Look for a long red candle with no upper or lower shadows, forming after:

- An uptrend (potential reversal)

- Or during a downtrend (continuation signal)

2. Confirm the Signal

Don’t trade the candle in isolation. Use confirmation tools such as:

✅ Next candle closes lower

✅ High volume on the Marubozu

✅ Resistance level nearby

✅ Bearish indicators (e.g., RSI turning down, MACD bearish crossover)

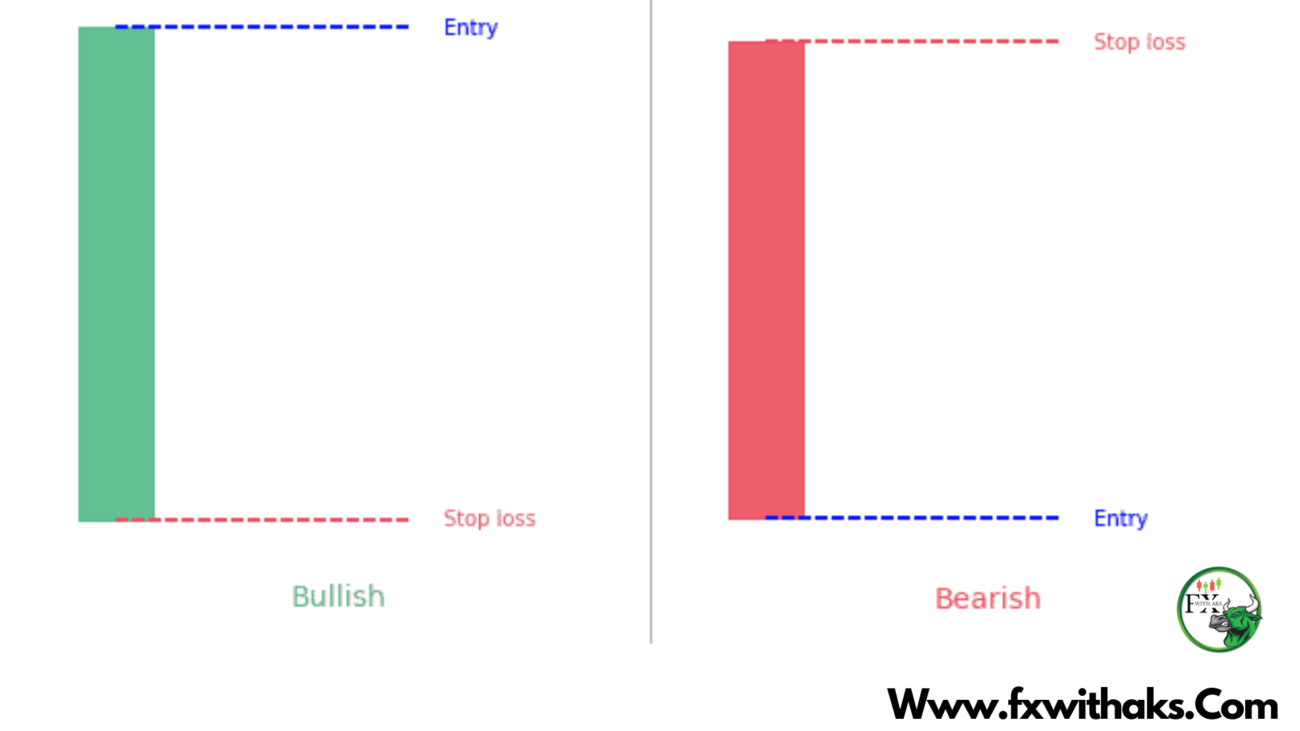

3. Entry Point

📌 Aggressive Entry:

Enter immediately after the Bearish Marubozu closes, especially if there’s strong confluence (e.g., resistance zone, high volume).

📌 Conservative Entry:

Wait for the next candle to break the low of the Marubozu before entering short.

4. Stop Loss Placement

🛑 Place your stop loss:

- Just above the high of the Bearish Marubozu

- Or above a nearby resistance level

This helps limit your risk in case the pattern fails.

5. Profit Targets

🎯 Use any of the following to set targets:

- Support levels

- Fibonacci retracements

- Risk:Reward ratio (e.g., 1:2 or 1:3)

🧠 Pro Tips:

- Best used on higher timeframes (1H, 4H, Daily) for stronger signals.

- Combine with other patterns or indicators for more reliable trades.

- Avoid trading solely on Marubozu in choppy or low-volume markets.

Would you like a visual or example setup on a chart?