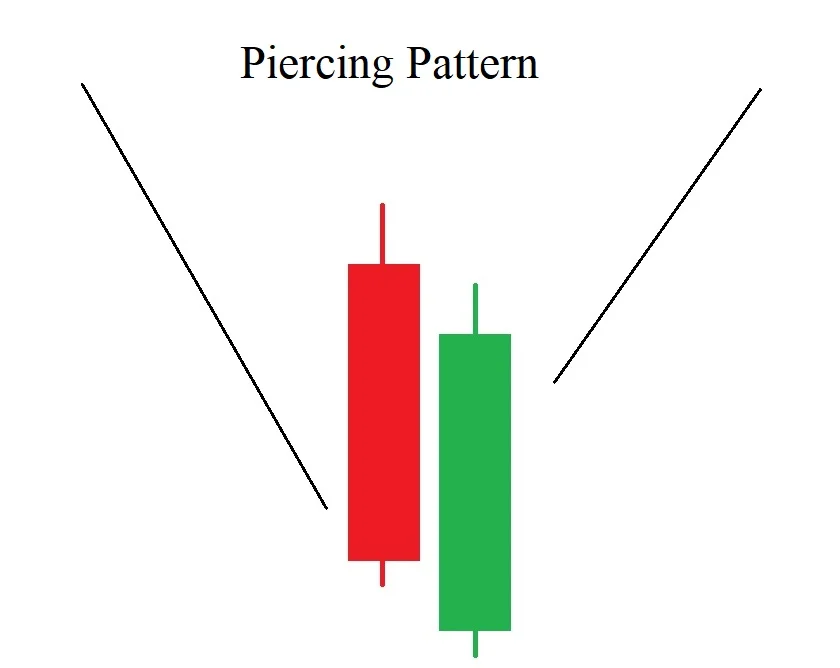

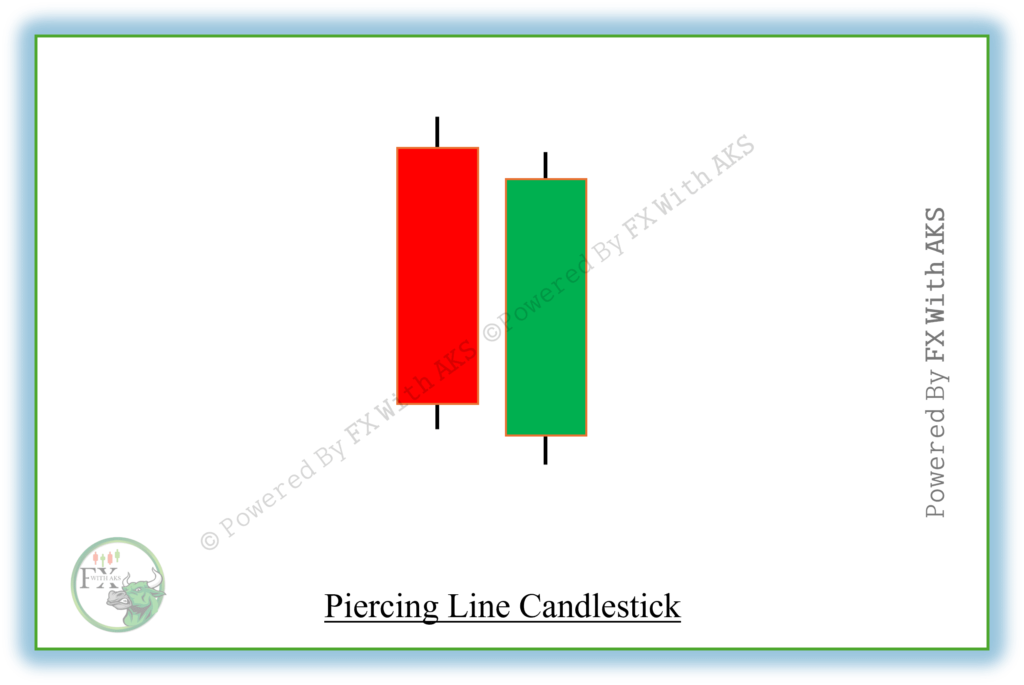

The Piercing Line is a bullish candlestick pattern that typically appears at the end of a downtrend, signaling a potential reversal to the upside. It consists of two candles:

- First Candle (Bearish): A long red (black) candlestick that closes near its low.

- Second Candle (Bullish): A long green (white) candlestick that opens below the previous candle’s low but closes above the midpoint of the first candle’s body.

Key Characteristics:

- Occurs after a downtrend.

- The second candle gaps down at the open but then closes above the midpoint of the previous red candle.

- Shows strong buying pressure as bulls regain control.

Interpretation:

- The gap down initially suggests that the bearish momentum is continuing.

- However, the strong upward movement of the second candle signals a shift in sentiment.

- If the next candlestick confirms the reversal (by closing higher), it strengthens the bullish signal.

Trading Strategy:

- Entry: Consider entering a long position when the next candle confirms the reversal with a higher close.

- Stop-Loss: Below the low of the second candle to manage risk.

- Target: Look for resistance levels or use a risk-reward ratio of 2:1.

Structure of the Piercing Line Pattern

- First Candle (Bearish):

- A long red (or black) candle.

- Indicates strong selling pressure.

- Second Candle (Bullish):

- Opens below the low of the previous red candle (gap down).

- Closes above the midpoint of the first candle’s body.

- The deeper the second candle closes into the first, the stronger the signal.

Psychological Interpretation

- The bears are in control during the first day.

- On the second day, the market opens lower (suggesting continued bearish sentiment) but buyers step in, pushing the price higher.

- A close above the midpoint of the first candle signals that bulls are gaining momentum.

Key Confirmation Factors

- Appears after a clear downtrend.

- High trading volume on the second (bullish) candle.

- Ideally confirmed by a third bullish candle closing higher.

Comparison with Similar Patterns

- Bullish Engulfing: The second candle completely engulfs the first.

- Piercing Line: The second candle only pierces more than halfway into the first.

Example Illustration

sqlCopyEdit Day 1: ▼ Red Candle

Open: 100

Close: 90

Day 2: ▲ Green Candle

Open: 85 (gap down)

Close: 95 (closes above 90's midpoint of 95)