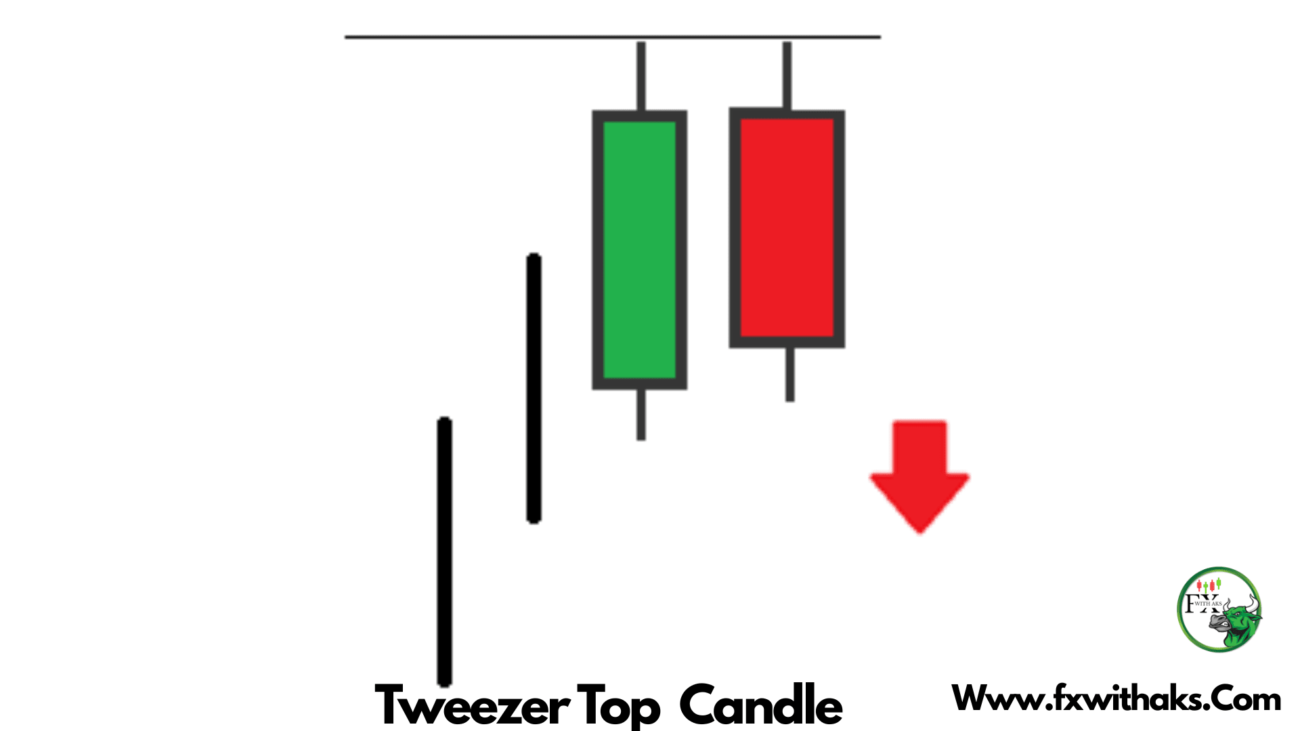

The Tweezer Top is a bearish candlestick reversal pattern that appears after an uptrend, signaling that the upward momentum might be weakening and a potential trend reversal is coming.

🔥 Tweezer Top Pattern Structure

It consists of two candles:

- First Candle

- Bullish (green or white)

- Continues the existing uptrend

- Has a high wick or upper shadow

- Second Candle

- Bearish (red or black)

- Opens around the same level the previous candle closed

- High matches or is very close to the high of the first candle

- Shows rejection of higher prices

📉 What It Indicates

- Buyers pushed the price up, but failed to go beyond a certain level twice in a row.

- Sellers stepped in on the second candle with enough strength to stop the uptrend.

- It signals a potential bearish reversal.

🛠️ How to Use It in Trading

| Action | How to Apply |

|---|---|

| Exit Long Positions | Use it as a warning that the uptrend may be ending. |

| Enter Short Trades | After confirmation from the next candle (e.g. a bearish follow-through). |

| Set Stop-Loss | Just above the high of the Tweezer Top. |

| Combine With | RSI (overbought), MACD, volume spikes, resistance levels |

How To Trade With Tweezer Top Candle

Trading with the Tweezer Top candlestick pattern can be a great way to spot potential bearish reversals — especially when combined with other tools. Here’s a step-by-step guide on how to do it:

📌 1. Identify the Pattern

- Look for it at the top of an uptrend

- Two candles with matching or nearly matching highs

- First candle: bullish

- Second candle: bearish, often showing rejection of the same high

🧠 Tip: The more similar the highs and the stronger the bearish second candle, the better.

📊 2. Confirm the Reversal

To avoid false signals, combine with:

- RSI above 70 → overbought conditions

- MACD bearish crossover

- Resistance level or Fibonacci level

- Bearish volume spike on the second candle

📉 Look for a third candle that closes lower — this acts as confirmation.

💼 3. Entry Strategy

| Scenario | Entry Point |

|---|---|

| Conservative | Enter on the next candle after the Tweezer Top, only if it closes lower |

| Aggressive | Enter at the close of the second (bearish) candle |

🛡️ 4. Stop-Loss Placement

- Place your stop-loss just above the high of the Tweezer Top

- This keeps your risk controlled in case of a fakeout

🎯 5. Set Profit Targets

- First target: recent support level or swing low

- Second target (optional): use Fibonacci retracements or a trailing stop for extended moves

🧮 Example:

- Price is trending up

- Tweezer Top forms at a key resistance zone

- RSI is above 70

- You enter short at the next candle’s open

- Stop above the highs, target previous support

Would you like a visual chart setup or a backtested strategy based on this pattern?