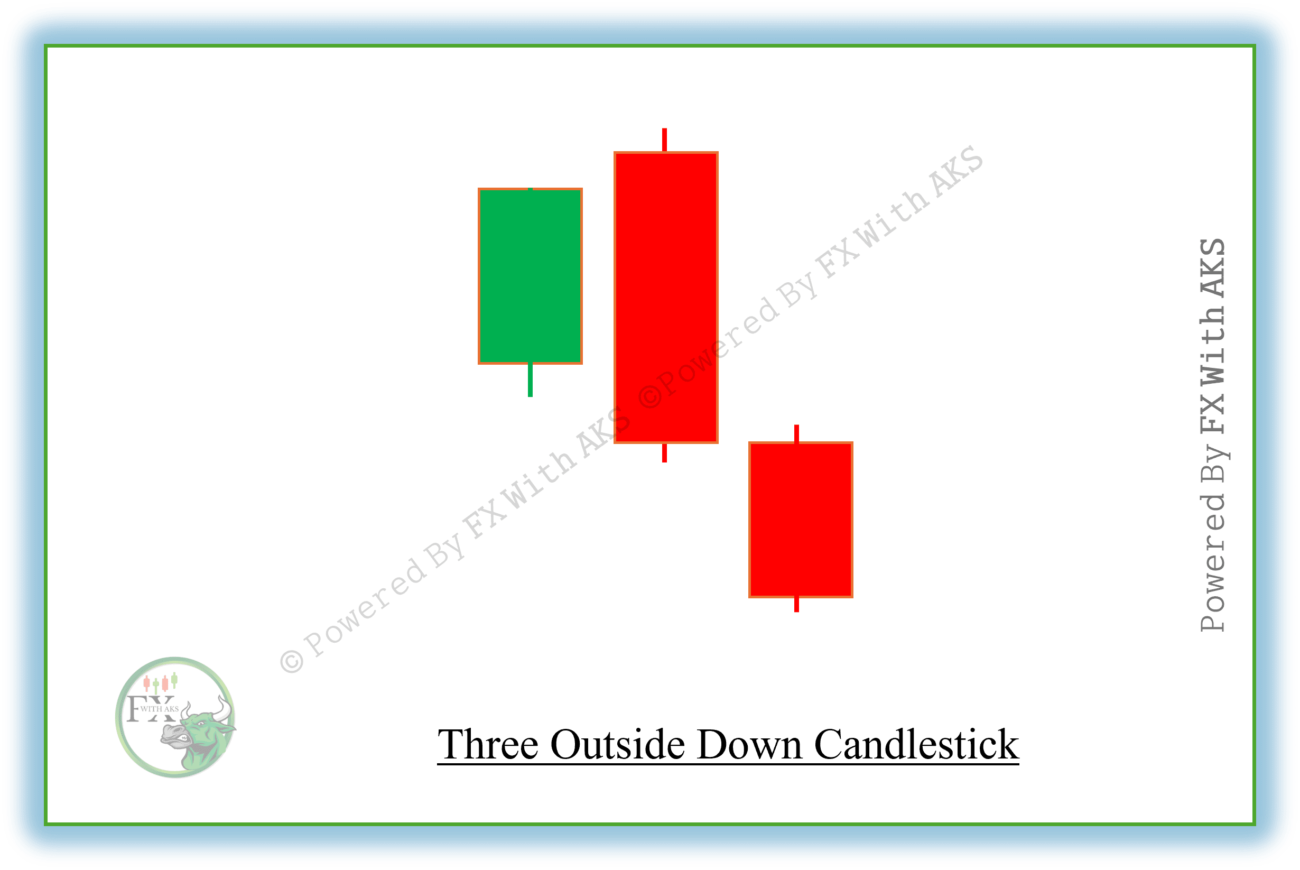

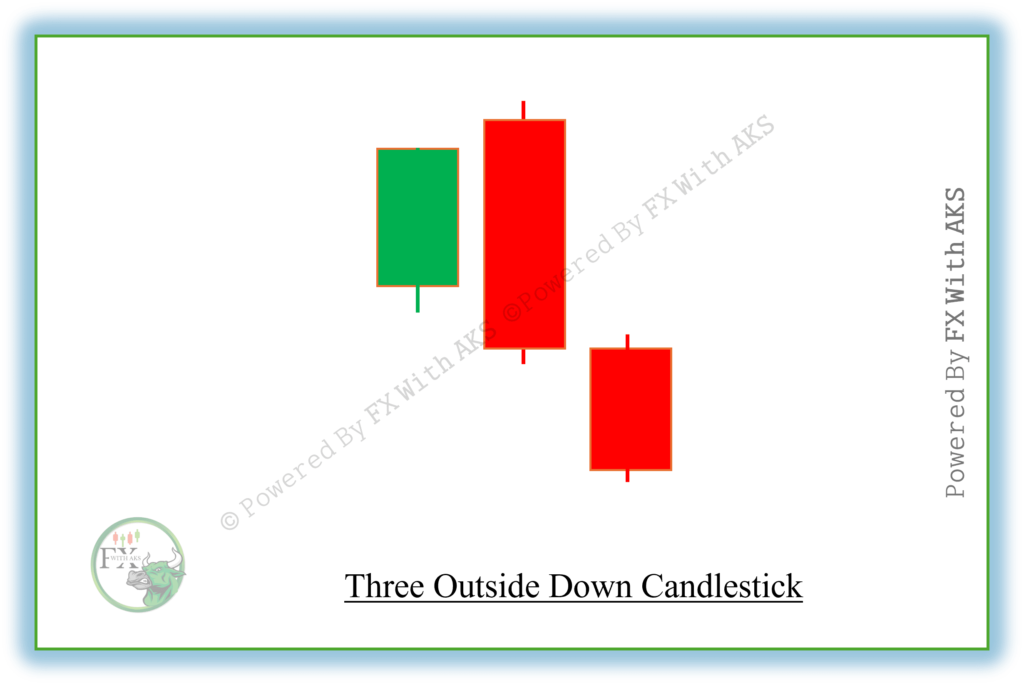

The Three Outside Down is a bearish reversal candlestick pattern that typically appears at the top of an uptrend. It signals increasing selling pressure and often marks the start of a downward reversal.

🕯️ Structure of the Three Outside Down Pattern

It consists of three candles:

- First Candle:

- A small bullish (green/white) candle.

- Indicates the uptrend is still in place but possibly weakening.

- Second Candle:

- A large bearish (red/black) candle.

- Engulfs the entire body of the first candle (like a Bearish Engulfing pattern).

- Shows a strong reversal move.

- Third Candle:

- Another bearish candle.

- Closes lower than the second candle, confirming follow-through by the bears.

▲ ← Small Bullish Candle

▼ ← Large Bearish Candle (engulfs the first)

▼ ← Another Bearish Candle (closes even lower)

📉 Interpretation

- First candle shows weak bullish effort.

- Second candle shows strong bearish reversal (engulfing).

- Third candle confirms the continuation of the reversal — sellers are firmly in control.

✅ Strongest When:

- Appears after a clear uptrend.

- Third candle closes with high volume.

- Reinforced by resistance or bearish divergence (e.g., RSI, MACD).

🔁 Related Pattern

| Pattern | Signal | Opposite Pattern |

|---|---|---|

| Three Outside Down | Bearish | Three Outside Up (Bullish) |

| Bearish Engulfing | Potential reversal | Three Outside Down confirms it |

⚠️ Notes for Traders

- Confirmation is key – don’t act until the third candle closes.

- Combine with trendline breaks, volume analysis, or indicators like moving averages for better results.

- Often used in swing trading to spot early shorting opportunities.

Would you like a script to detect this pattern or help spotting examples on a specific stock or time frame?