The Head and Shoulders pattern is a reversal pattern in technical analysis that signals a potential trend change. There are two main types:

- Head and Shoulders Top – bearish reversal (forms after an uptrend)

- Inverse Head and Shoulders – bullish reversal (forms after a downtrend)

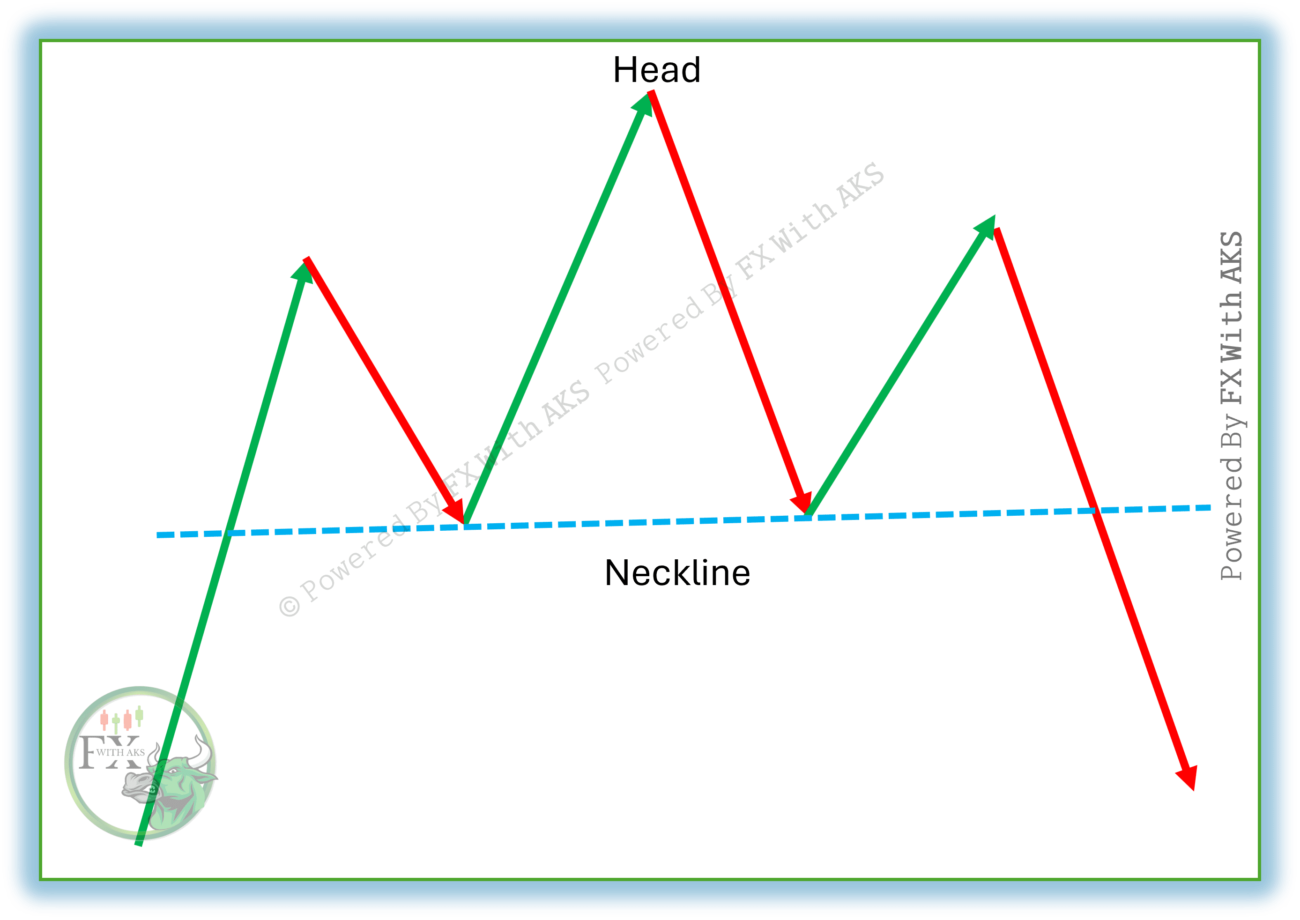

🧠 Head and Shoulders (Top) – Bearish Reversal

📈 Structure:

- Left Shoulder: Price rises, then falls.

- Head: Price rises again to a higher peak, then falls.

- Right Shoulder: Price rises again but to a lower peak than the head, then falls.

- Neckline: A support line connecting the two troughs (can be horizontal or sloped).

- Breakdown: When price breaks below the neckline = sell signal.

📉 Target Price:

Target = Neckline – (Head – Neckline)

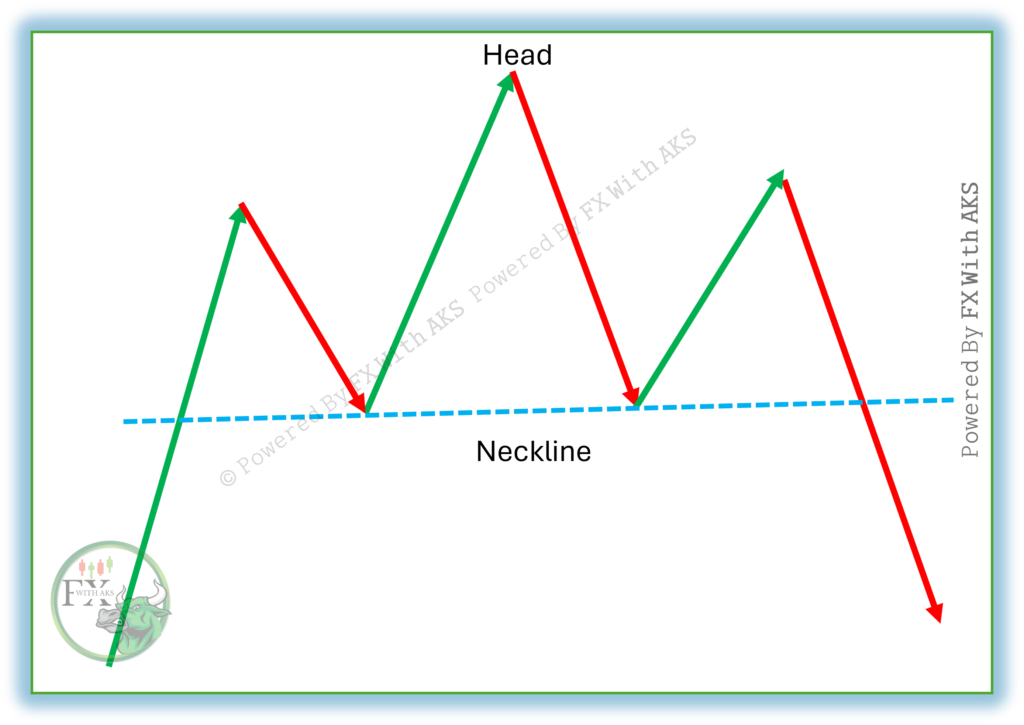

🔄 Inverse Head and Shoulders – Bullish Reversal

📉 Structure:

- Left Shoulder: Price drops, then bounces.

- Head: Price drops further to a lower low, then bounces.

- Right Shoulder: Price drops again but not as low as the head.

- Neckline: Connects the highs between shoulders/head.

- Breakout: When price breaks above the neckline = buy signal.

📈 Target Price:

Target = Neckline + (Neckline – Head)

✅ Key Characteristics

| Feature | Description |

|---|---|

| Trend | Top: uptrend reversal; Inverse: downtrend reversal |

| Volume | Should decrease through pattern; rise at breakout |

| Neckline | Crucial level for confirmation |

| Confirmation | Only after price breaks neckline |

| Reliability | One of the most reliable reversal patterns |

⚠️ Things to Watch Out For

- Sloped necklines: Affect target projection and timing.

- Premature entries: Wait for breakout confirmation.

- Fakeouts: Use volume and other indicators for confirmation (e.g., RSI divergence).

Would you like a visual chart, or code to detect this in TradingView (Pine Script)?