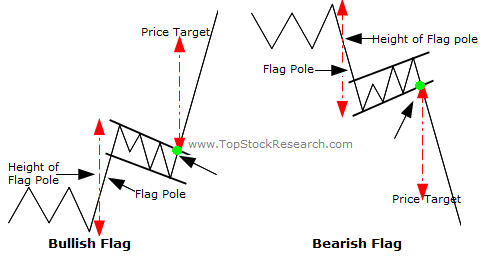

The Flag and Pole pattern is a continuation pattern in technical analysis that signals a brief consolidation before the prevailing trend resumes. It resembles a flag on a pole when visualized on a chart.

🏁 Flag and Pole Pattern Explained

📏 Structure:

- Pole:

- A sharp, nearly vertical price movement (up or down) with strong volume.

- Indicates strong buying (in uptrend) or selling (in downtrend) pressure.

- Flag:

- A short-term consolidation zone that slopes against the trend (can be horizontal or slightly sloped).

- Formed by parallel trendlines (like a mini channel).

- Volume typically declines during this phase.

- Breakout:

- Price breaks out of the flag in the same direction as the pole.

- Volume should increase on the breakout.

📊 Types of Flag Patterns

| Pattern Type | Trend Before Flag | Flag Slope | Breakout Direction |

|---|---|---|---|

| Bull Flag | Strong uptrend | Slightly downward | Upward |

| Bear Flag | Strong downtrend | Slightly upward | Downward |

💡 Target Price Calculation

Target = Breakout point + (Height of the pole)

For Bear Flag:

Target = Breakout point - (Height of the pole)

✅ Example (Bull Flag)

- Price rises from $50 to $70 quickly → Pole = $20

- Then price consolidates between $66 and $68 forming a downward-sloping flag.

- Price breaks above $68 → Target = $68 + $20 = $88

🔍 Key Characteristics

| Feature | Description |

|---|---|

| Trend Direction | Continuation of prevailing trend |

| Volume | High during pole, low in flag, high at breakout |

| Timeframe | Pole: short & sharp; Flag: brief consolidation |

| Reliability | High, especially when supported by volume |

⚠️ Watch Out For

- Flags that take too long may lose momentum.

- Breakouts without volume can fail.

- Fakeouts: Use confirmation (e.g., RSI, MACD, breakout candle close).

Would you like a visual example, or a way to code/scan this in TradingView or other platforms?