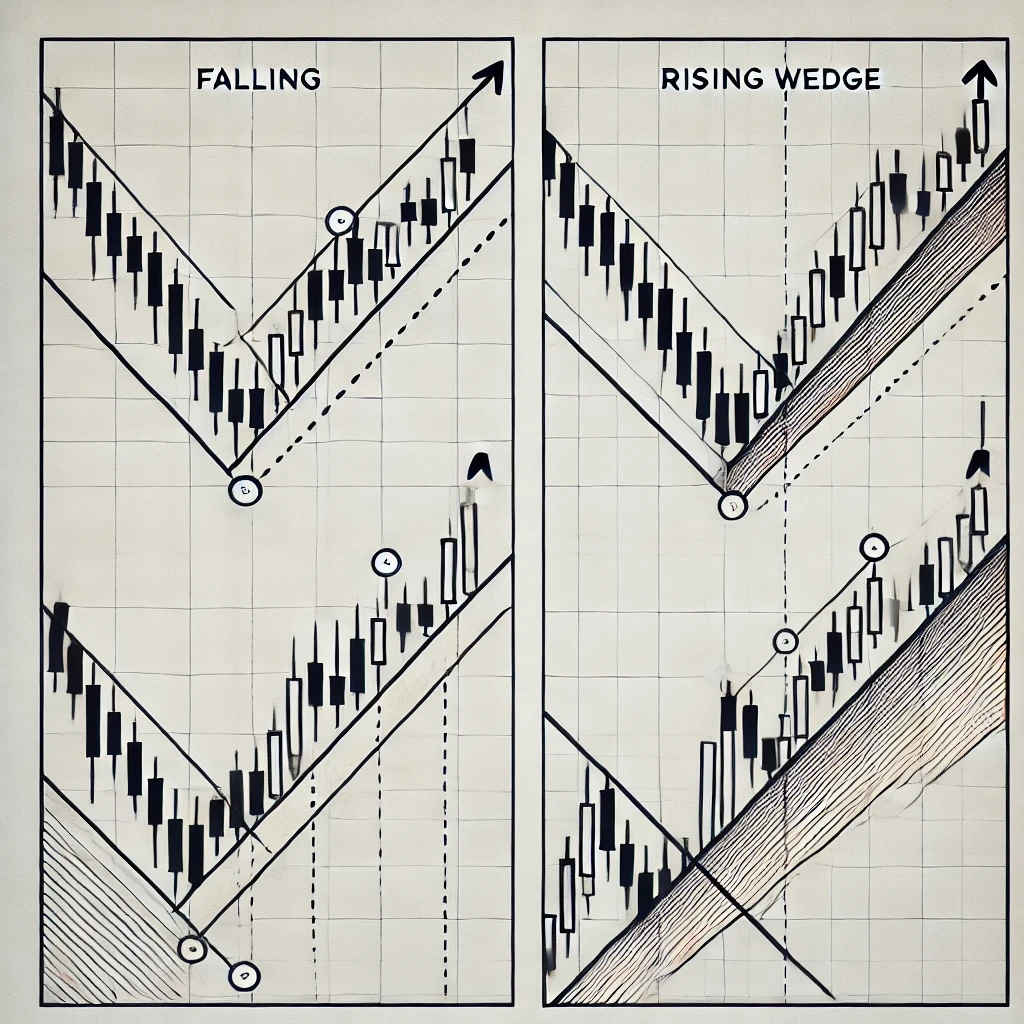

Falling Wedge

A falling wedge is a bullish chart pattern that signals a potential reversal or continuation of an uptrend.

It forms when price action consolidates between two downward-sloping trend lines that converge over time. Here’s how it works:

Key Characteristics

- Downward Sloping: Both resistance (upper) and support (lower) trendlines slope downward, with the upper line being steeper.

- Converging Lines: The price range narrows as it moves toward the apex of the wedge.

- Volume Decline: Trading volume generally decreases as the pattern develops.

- Breakout Direction: Typically, the price breaks out upward, signaling a bullish move.

Types of Falling Wedges

- Reversal Pattern: Appears after a downtrend and signals a potential trend reversal upward.

- Continuation Pattern: Occurs within an uptrend, indicating a temporary pullback before the price resumes rising.

How to Trade It

- Entry Point: Buy when price breaks above the resistance line with high volume.

- Stop-Loss: Place below the recent

Rising Wedge

A rising wedge is a bearish chart pattern that signals a potential reversal or continuation of a downtrend. It forms when price action consolidates between two upward-sloping trendlines that converge over time.

Key Characteristics

- Upward Sloping: Both resistance (upper) and support (lower) trendlines slope upward, with the lower trendline being steeper.

- Converging Lines: The price range narrows as it moves toward the apex of the wedge.

- Volume Decline: Trading volume generally decreases as the pattern develops.

- Breakout Direction: Typically, the price breaks out downward, signaling a bearish move.

Types of Rising Wedges

- Reversal Pattern: Appears after an uptrend and signals a potential trend reversal downward.

- Continuation Pattern: Occurs within a downtrend, indicating a temporary pullback before the price resumes falling.

How to Trade It

- Entry: Enter a short position when the price breaks below the lower trendline.

- Stop-Loss: Place a stop-loss just above the recent swing high.

- Target: Measure the height of the wedge at its widest point and project it downward from the breakout.

Would you like a comparison between the falling wedge and rising wedge for better clarity? 🚀

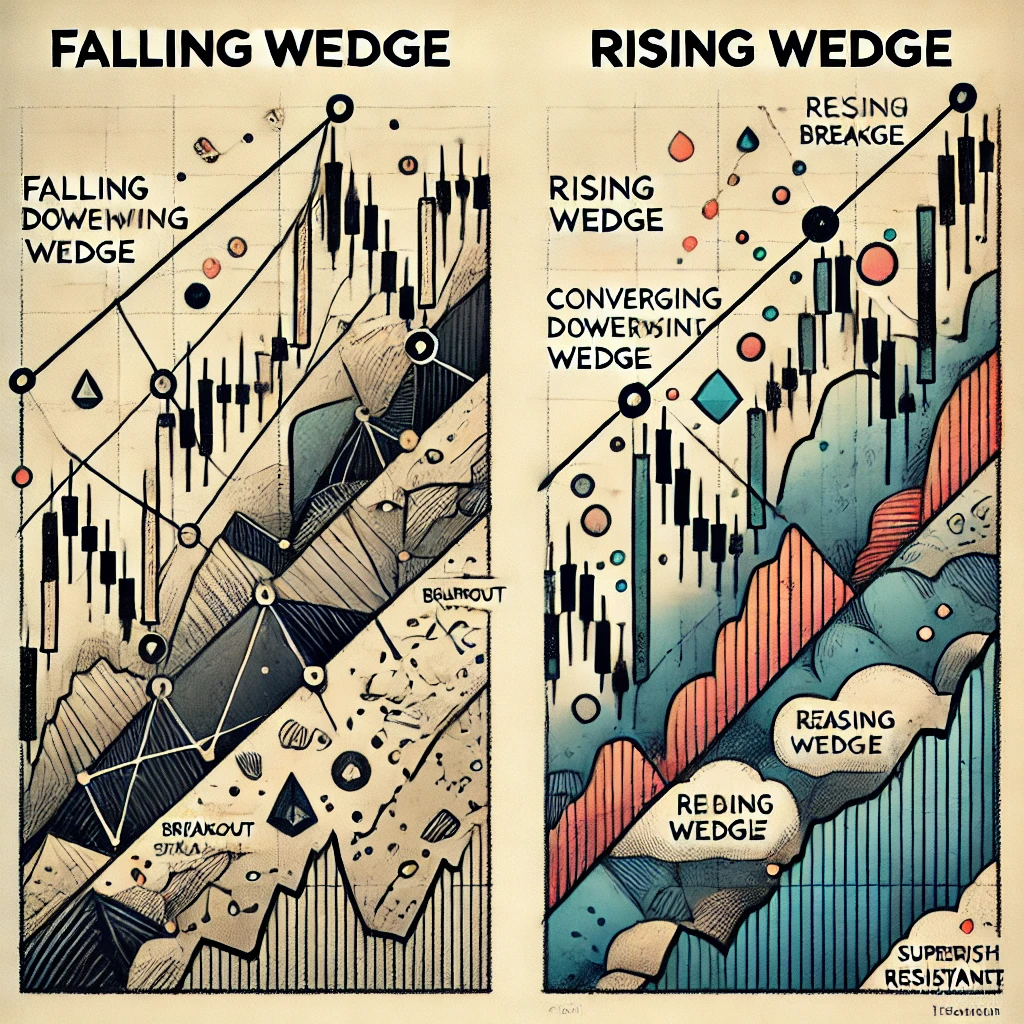

Difference Between Falling Wedge & Rising Wedge

Here’s an image illustrating the Falling Wedge (bullish) and Rising Wedge (bearish) patterns:

Falling Wedge (Bullish)

- Price consolidates within two downward-sloping, converging trendlines.

- Typically breaks out upward with increased volume.

Rising Wedge (Bearish)

- Price consolidates within two upward-sloping, converging trendlines.

- Typically breaks out downward with increased volume.

Generating the image now… 🎨📈

What Is a Wedge Pattern?

A wedge pattern forms when price moves within two converging trendlines, creating a narrowing structure.

This indicates decreasing momentum and often leads to a powerful breakout.

Key Characteristics of Wedge Patterns:

- Price consolidation with higher lows and lower highs

- Market indecision before a strong move

- Can act as reversal or continuation patterns

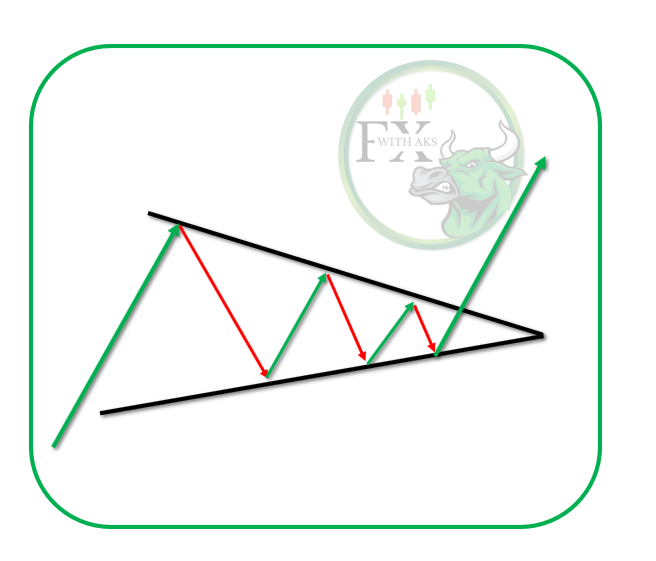

Falling Wedge Pattern (Bullish)

What Is a Falling Wedge?

A Falling Wedge occurs when price moves downward while forming:

- Lower highs

- Lower lows

- A tightening price range

Despite falling prices, selling momentum weakens over time, preparing the market for a bullish move.

Why Falling Wedge Is Bullish

- Sellers lose strength

- Buyers slowly step in

- Breakout usually happens upward

Best Market Conditions

- During a downtrend (reversal)

- During an uptrend (continuation)

- Near strong support zones

How to Trade the Falling Wedge Pattern

Entry Rules

- Identify a clear falling wedge structure

- Wait for a strong bullish breakout

- Enter Buy after candle closes above resistance

Stop Loss

- Below the most recent swing low

Target

- Measure the height of the wedge

- Or target the nearest resistance level

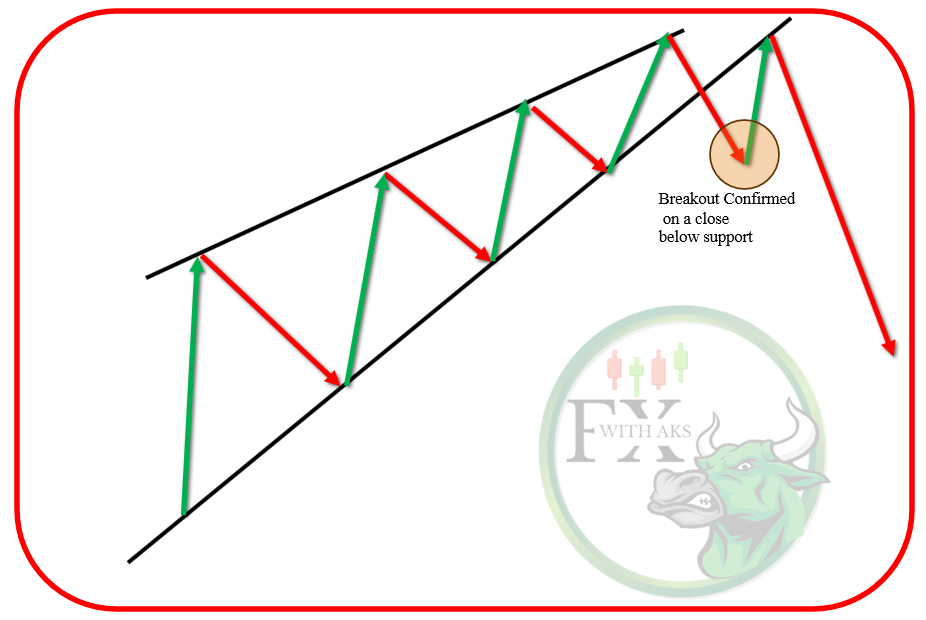

Rising Wedge Pattern (Bearish)

What Is a Rising Wedge?

A Rising Wedge forms when price moves upward while creating:

- Higher highs

- Higher lows

- A narrowing range

Although price is rising, buying momentum weakens, often leading to a bearish breakdown.

Why Rising Wedge Is Bearish

- Buyers lose momentum

- Sellers begin to dominate

- Breakdown typically occurs downward

Best Market Conditions

- During an uptrend (reversal)

- During a downtrend (continuation)

- Near major resistance zones

How to Trade the Rising Wedge Pattern

Entry Rules

- Identify a well-defined rising wedge

- Wait for a confirmed bearish breakdown

- Enter Sell after candle closes below support

Stop Loss

- Above the most recent swing high

Target

- Pattern height projection

- Or next support zone

Falling Wedge vs Rising Wedge (Comparison Table)

| Feature | Falling Wedge | Rising Wedge |

|---|---|---|

| Direction | Downward | Upward |

| Bias | Bullish | Bearish |

| Breakout | Up | Down |

| Momentum | Weak selling | Weak buying |

| Best Use | Buy setups | Sell setups |

Common Mistakes Traders Make

❌ Trading before breakout confirmation

❌ Ignoring volume

❌ Placing tight stop losses

❌ Trading against higher timeframe trend

Pro Tips for High Accuracy

✔ Always wait for candle close confirmation

✔ Combine with volume, RSI, moving averages

✔ Use higher timeframes (H1, H4, Daily)

✔ Apply proper risk management (1:2 RR or better)

Best Markets for Wedge Patterns

- Forex: EURUSD, GBPUSD, USDJPY

- Crypto: BTCUSD, ETHUSD

- Commodities: Gold (XAUUSD)

- Indices & Stocks

Final Thoughts

The Falling Wedge and Rising Wedge patterns are powerful tools when traded with patience and confirmation. They offer clear entries, defined risk, and strong reward potential.

Remember:

Patterns work best when combined with trend, volume, and disciplined risk management.