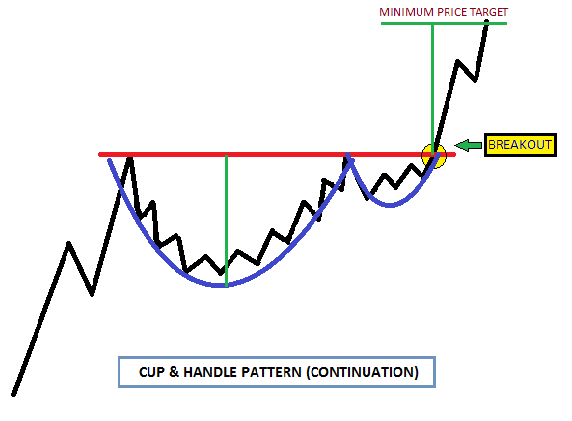

The Cup and Handle pattern is a bullish continuation pattern in technical analysis, typically signaling a potential upward breakout after a period of consolidation. It resembles the shape of a teacup on a price chart.

📈 Structure of the Pattern

- Cup:

- Rounded bottom: The price gradually declines, forms a rounded bottom, then rises back to approximately the previous high.

- Timeframe: Can form over several weeks to months.

- Shows a period of consolidation and accumulation.

- Handle:

- Shorter pullback: After reaching the previous high, the price pulls back slightly, forming a downward-sloping or horizontal channel (the “handle”).

- Lower volume often observed during the handle.

- Timeframe: Typically shorter than the cup, often a few days to weeks.

- Breakout:

- When price breaks above the resistance level formed by the cup’s rim, it’s considered a bullish signal.

- Volume should increase on breakout for confirmation.

📊 Key Characteristics

| Feature | Description |

|---|---|

| Trend Direction | Usually follows an uptrend |

| Cup Shape | U-shaped; V-shape is less reliable |

| Handle Decline | Ideally 10–15% from the rim |

| Breakout Signal | Above the handle’s resistance |

| Target Price | Height of cup added to breakout point |

✅ Example Use Case

- Stock XYZ is in an uptrend.

- It drops from $100 to $80, rounds out, and returns to $100.

- It pulls back to $95 (forming the handle).

- Breaks out above $100 on high volume.

- Target: $100 + ($100 – $80) = $120.

⚠️ Tips and Considerations

- Volume is critical: Low during the cup, lower during the handle, high during breakout.

- The pattern can fail—always manage risk with stop-losses.

- Best used in conjunction with other indicators (e.g., RSI, MACD).

Would you like an example chart or how to scan for this pattern using trading software?