The Evening Star Doji is a bearish reversal candlestick pattern that typically appears at the top of an uptrend. It’s a variation of the standard Evening Star, but with a Doji in the middle, making the signal even stronger due to the clear indecision it represents.

🕯️ Structure of the Evening Star Doji Pattern

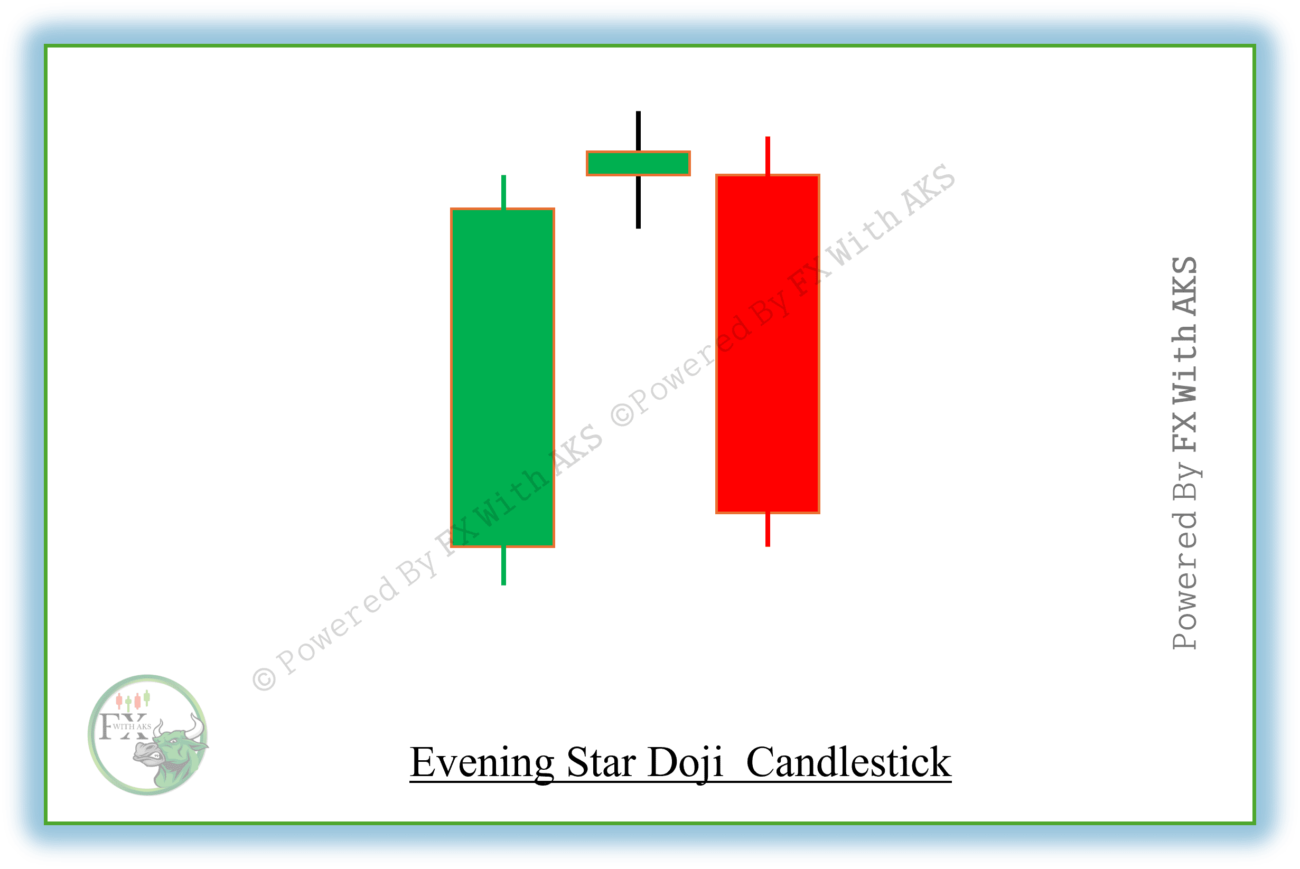

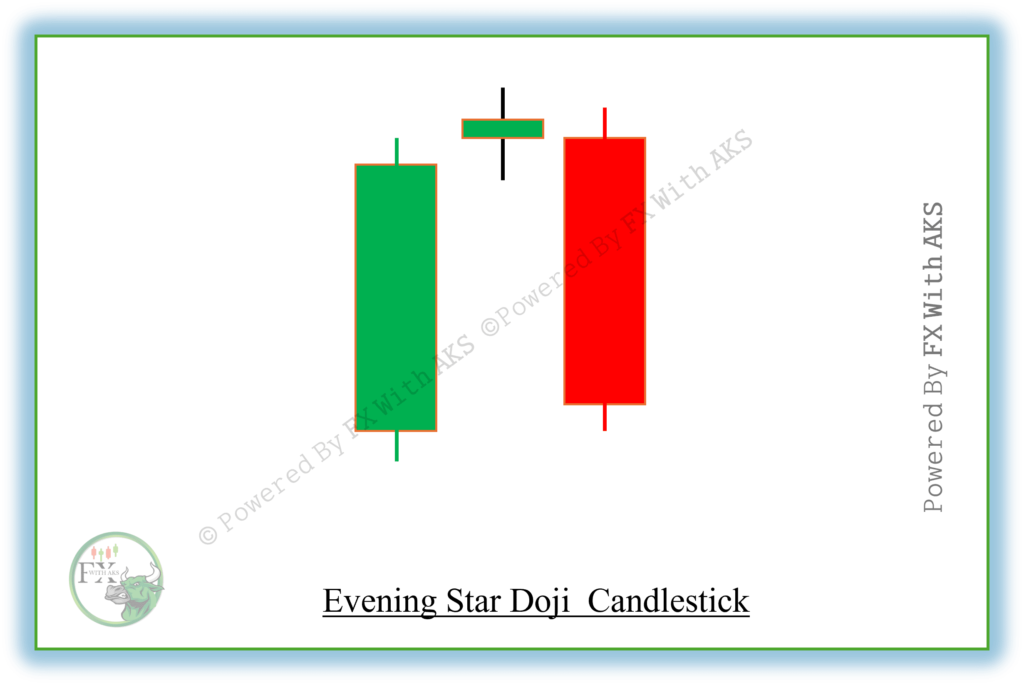

It consists of three candles:

- First Candle:Evening Star Doji

- A large bullish (green/white) candle.

- Confirms strong uptrend momentum.

- Second Candle (Doji):

- Opens above the first candle’s close (gap up).

- A Doji (open ≈ close), showing indecision or market balance.

- Signals a potential pause or loss of momentum.

- Third Candle:

- A large bearish (red/black) candle.

- Closes well into the body of the first candle, ideally below its midpoint.

- Confirms that bears are taking over.

javaCopyEdit ▲ ← Bullish Candle

┼ ← Doji (small body, long wicks)

▼ ← Bearish Candle (engulfs most of the first)

📈 Interpretation

- After an uptrend, buyers appear dominant (first candle).

- The Doji shows uncertainty and a potential turning point.

- The final bearish candle confirms a reversal is likely underway.

- Traders may view this as a signal to sell or take profits.

✅ Ideal Confirmation Factors

- Appears at the top of an uptrend.

- Doji forms a gap up (though gaps are more common in non-24hr markets like stocks).

- Third candle has strong volume and a close below the midpoint of the first candle.

- Additional confirmation from RSI divergence, MACD cross, or resistance levels adds strength.

🔁 Comparison with Similar Patterns

| Pattern | Middle Candle | Signal | Trend Direction |

|---|---|---|---|

| Evening Star | Small body | Bearish | Top of uptrend |

| Evening Star Doji | Doji | Stronger Bearish | Top of uptrend |

| Morning Star Doji | Doji | Bullish | Bottom of downtrend |