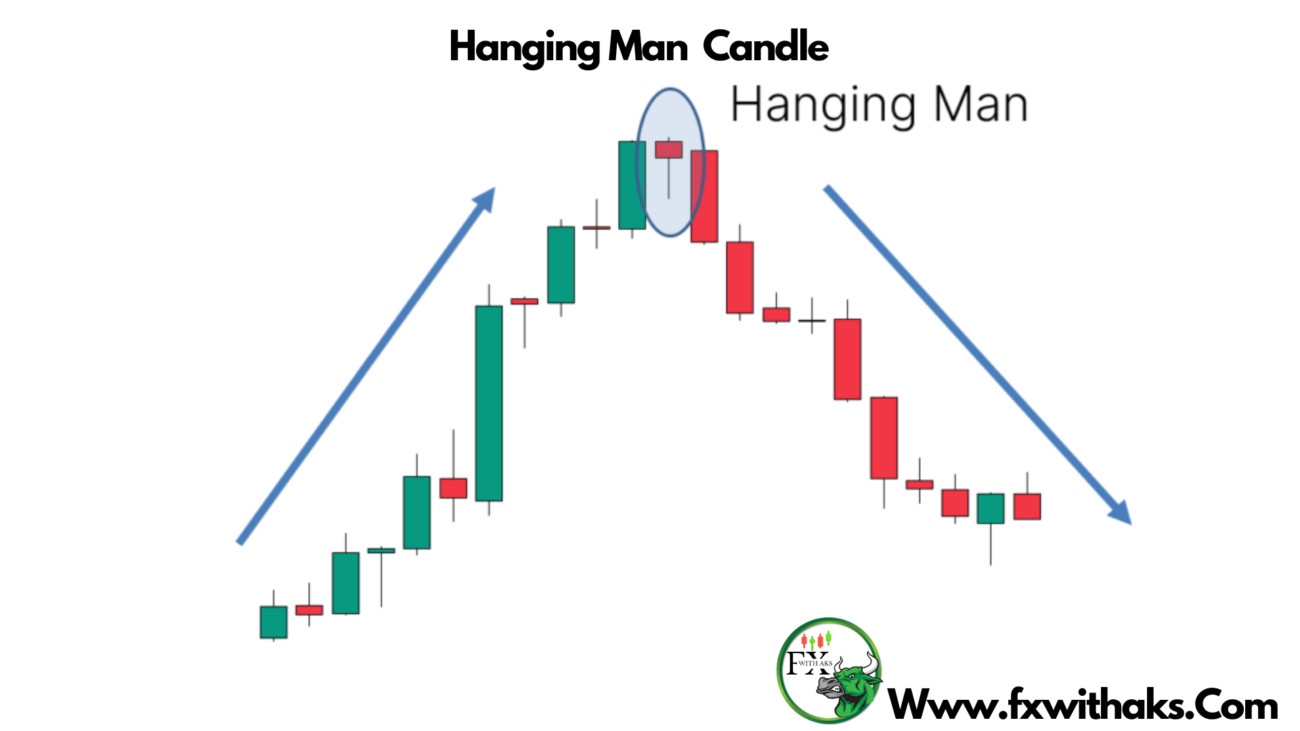

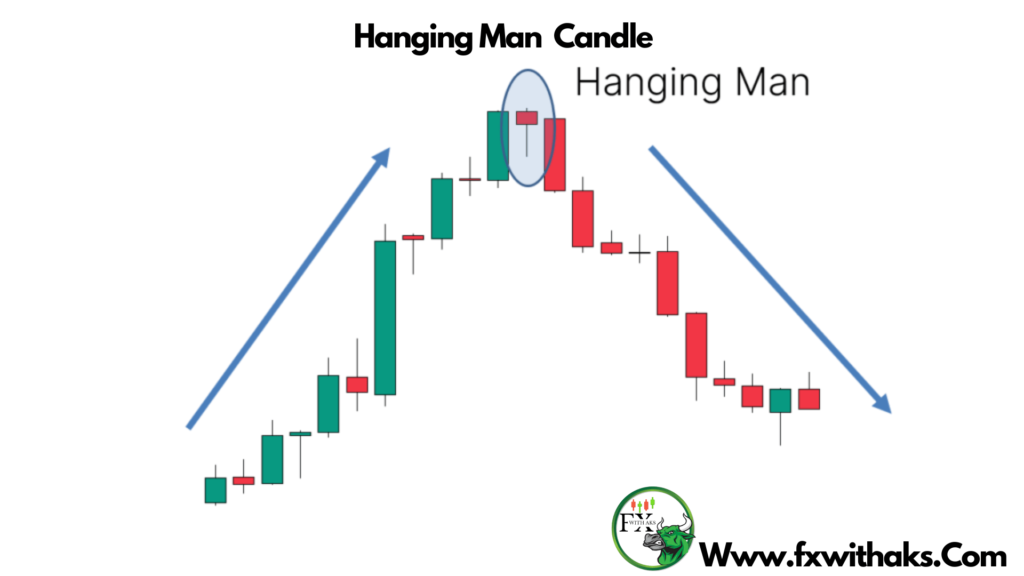

The Hanging Man candlestick is a bearish reversal pattern that appears after an uptrend, signaling that buying pressure may be weakening and a downtrend could be coming.

🪓 What is a Hanging Man Candle?

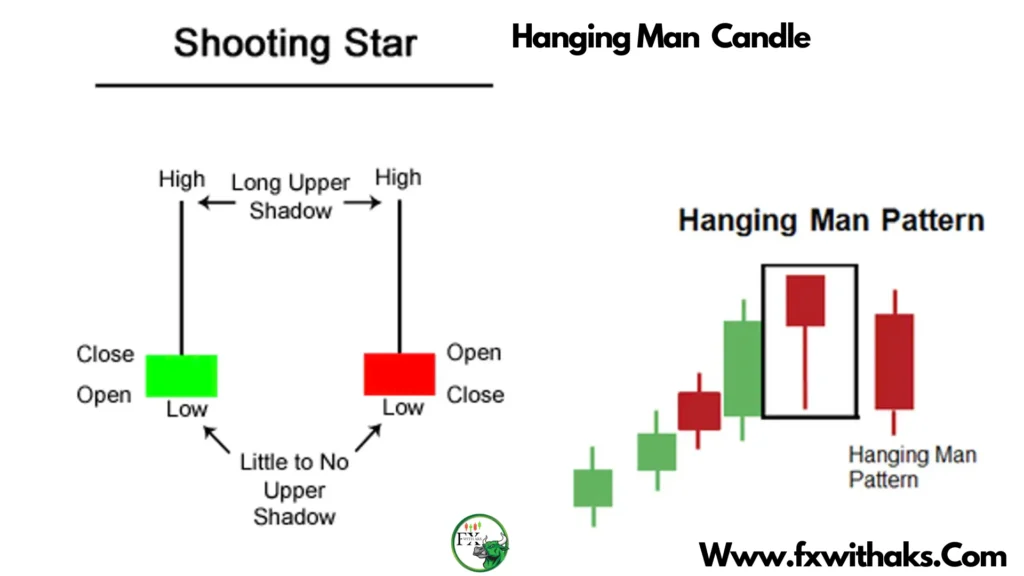

📌 Characteristics:

- Forms after a strong uptrend.

- Has a small real body near the top of the candle.

- Has a long lower shadow (at least 2x the body size).

- Little to no upper shadow.

🔍 Visual:

█

|

|

(The long lower wick shows selling pressure during the session.)

🧠 What It Tells You:

- Buyers pushed the price up during the uptrend.

- But during this session, sellers stepped in, pulling the price way down.

- Even though price closed near the top, the large lower shadow shows selling pressure is increasing.

➡️ It’s a warning: the bulls are losing control.

✅ How to Trade the Hanging Man Candle

1️⃣ Spot the Pattern

- Appears after an uptrend.

- Long lower wick, small body near the top.

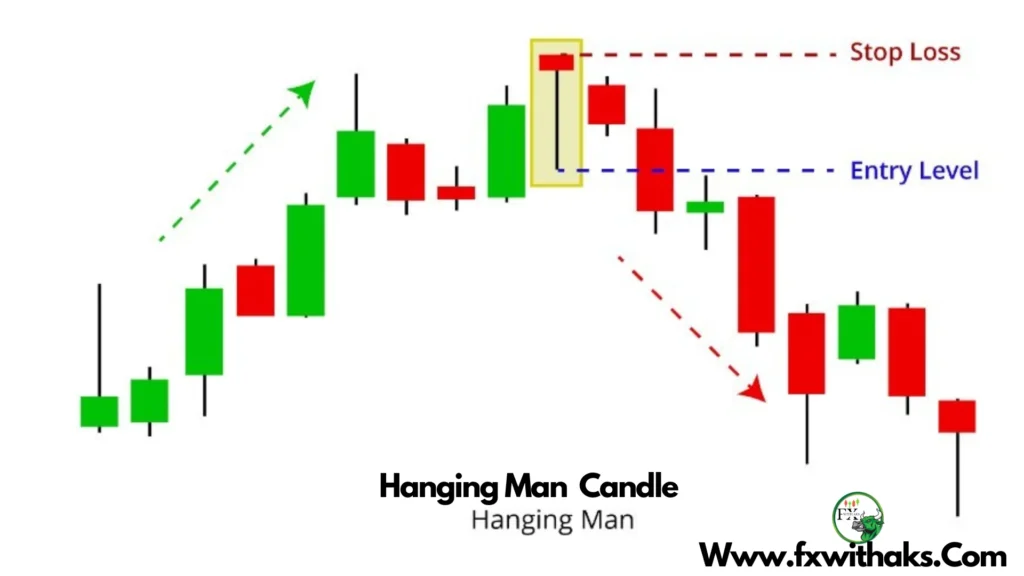

2️⃣ Wait for Confirmation

- Don’t enter based on the Hanging Man alone.

- Wait for the next candle to be bearish and close below the Hanging Man’s body.

- This confirms sellers are taking over.

3️⃣ Enter the Trade

- Enter a short position:

- At the close of the confirmation candle, or

- On a break below the Hanging Man’s low.

4️⃣ Place Stop-Loss

- Set stop-loss above the Hanging Man’s high.

- Gives room to avoid fakeouts.

5️⃣ Take-Profit Target

- Use:

- Previous support levels.

- Fibonacci retracement (38.2%, 50%, etc.).

- A solid risk/reward ratio like 2:1.

📊 Example Setup

| Element | Value |

|---|---|

| Trend | Uptrend |

| Pattern | Hanging Man |

| Entry | After confirmation candle |

| Stop-Loss | Above Hanging Man’s high |

| Take-Profit | Support zone / 2:1 R:R ratio |

🔑 Pro Tips:

- Stronger when:

- Volume is high on the Hanging Man candle.

- It forms at a resistance zone.

- Confirmed by other indicators (like RSI > 70 or MACD turning bearish).

- Works best on 4H or Daily timeframes.

Want me to generate a visual example, or compare it with the Hammer candle (they look similar but have different meanings)?