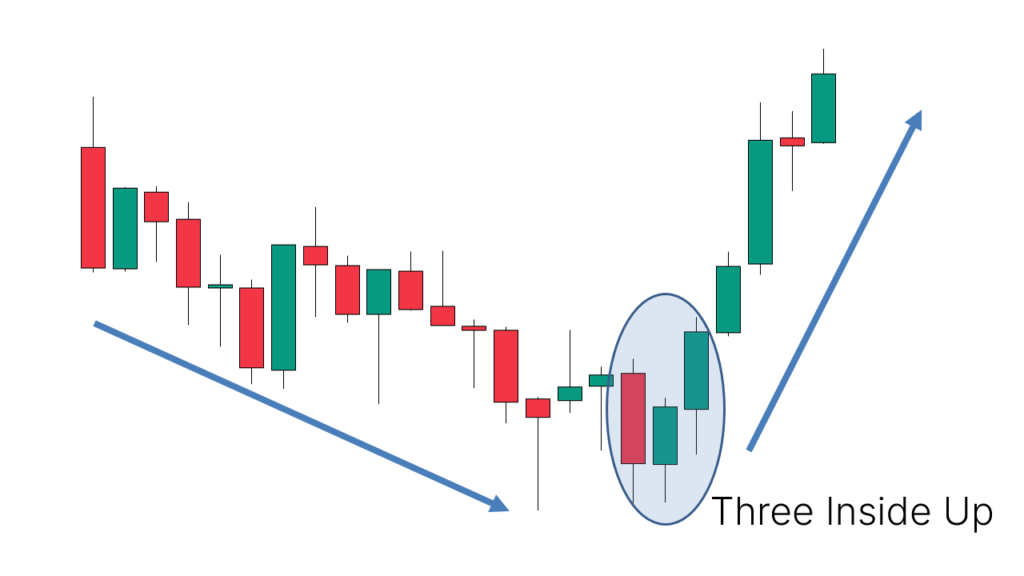

The Three Inside Up candlestick pattern is a bullish reversal pattern that appears after a downtrend.

It consists of three candles and signals a potential trend reversal to the upside. Here’s how it forms:

Formation of the Three Inside Up Pattern

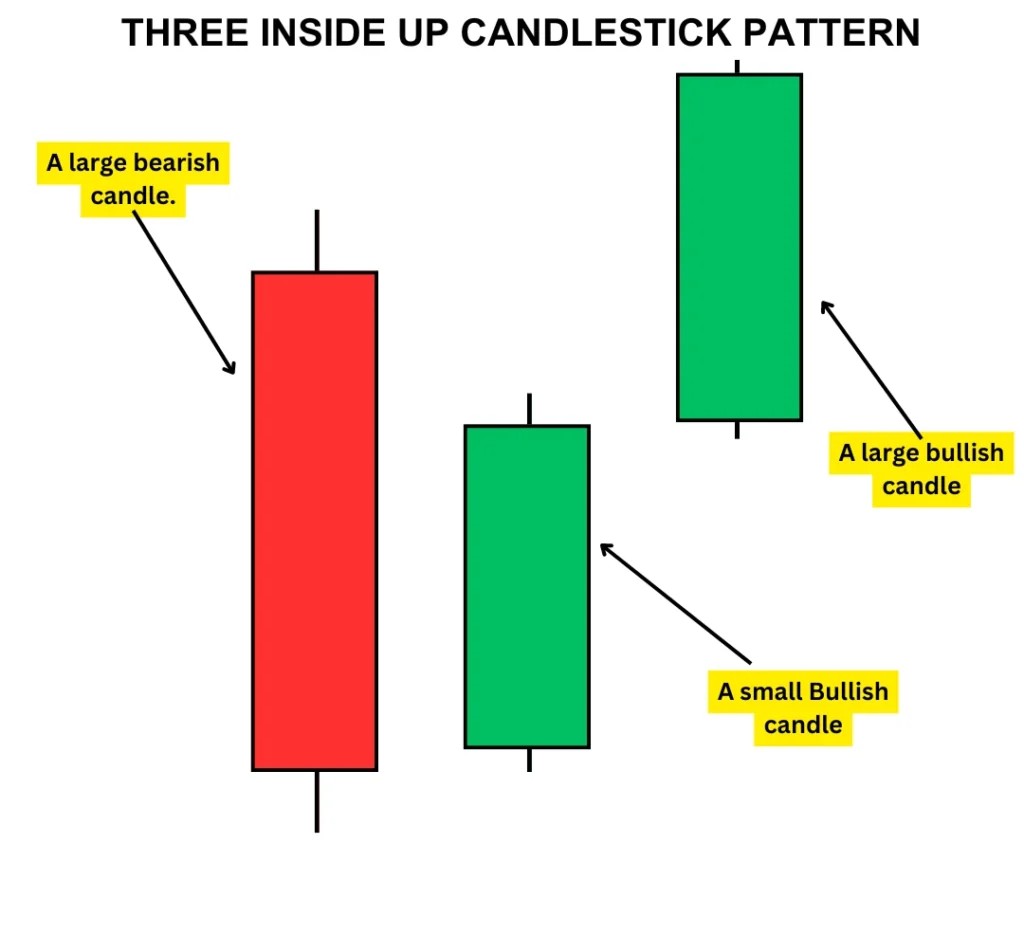

- First Candle: A large bearish (red) candle that continues the current downtrend.

- Second Candle: A smaller bullish (green) candle that forms inside the body of the first candle, indicating a potential reversal.

- Third Candle: A bullish candle that closes above the high of the first candle, confirming the reversal.

Key Features

- It suggests that the downtrend is losing momentum.

- The second candle being inside the first candle signals indecision.

- The third candle closing above the first candle’s high confirms the shift in market sentiment.

Trading Strategy

- Entry Point: Traders often enter a long position after the third bullish candle closes above the first candle’s high.

- Stop-Loss: Below the low of the second candle or first candle for risk management.

- Take-Profit: Depending on resistance levels, risk-reward ratio, or a trailing stop.

Reliability

- Stronger when found at key support levels.

- Higher volume on the third candle increases reliability.

- Can be used with other indicators like RSI or MACD for confirmation.

Would you like a visual representation or help with trading strategies for this pattern?

Proudly powered by FX With AKS