The Marubozu candlestick pattern is one of the strongest price action signals in technical analysis. It represents pure buying or selling pressure with almost no market hesitation, making it a favorite pattern among professional traders.

What Is a Marubozu Candlestick?

A Marubozu candle has:

- No upper or lower wicks (or very small ones)

- A long real body

- Clear dominance of either buyers or sellers

The word Marubozu comes from Japanese and means “bald” or “shaven”, indicating the absence of shadows.

A Bullish Marubozu is a strong candlestick pattern in technical analysis that signals strong buying pressure.

Types of Marubozu Candlestick Pattern

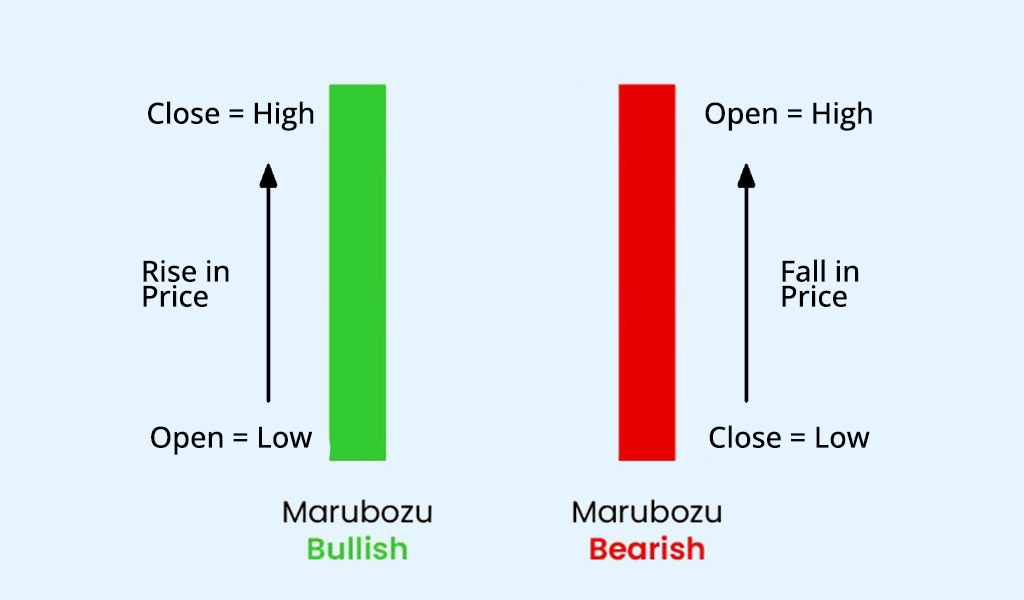

1. Bullish Marubozu

- Opens at the low

- Closes at the high

- Indicates strong buying momentum

- Signals continuation or start of an uptrend

Best used in: Uptrends, breakouts, support zones

It is characterized by a long green (or white) body with no wicks (shadows) on either end, meaning:

- Open = Low

- Close = High

2. Bearish Marubozu

- Opens at the high

- Closes at the low

- Indicates strong selling pressure

- Signals continuation or start of a downtrend

Best used in: Downtrends, breakdowns, resistance zones

Why Marubozu Is Important in Trading

✔ Shows institutional strength

✔ Confirms trend continuation

✔ Useful for breakout and momentum trading

✔ Works well on Forex, Crypto, Stocks, Indices, Gold (XAUUSD)

How to Trade Using Marubozu Pattern

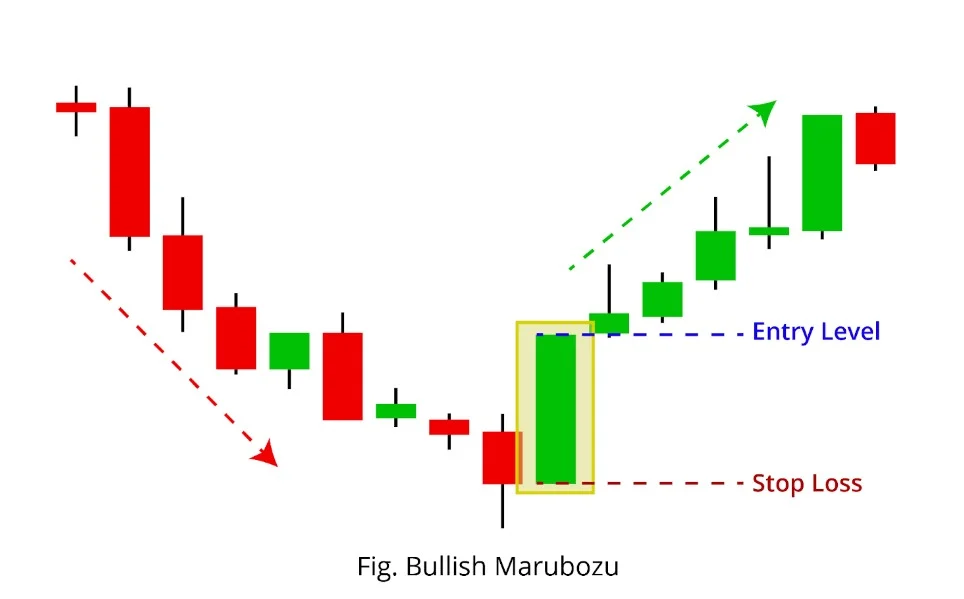

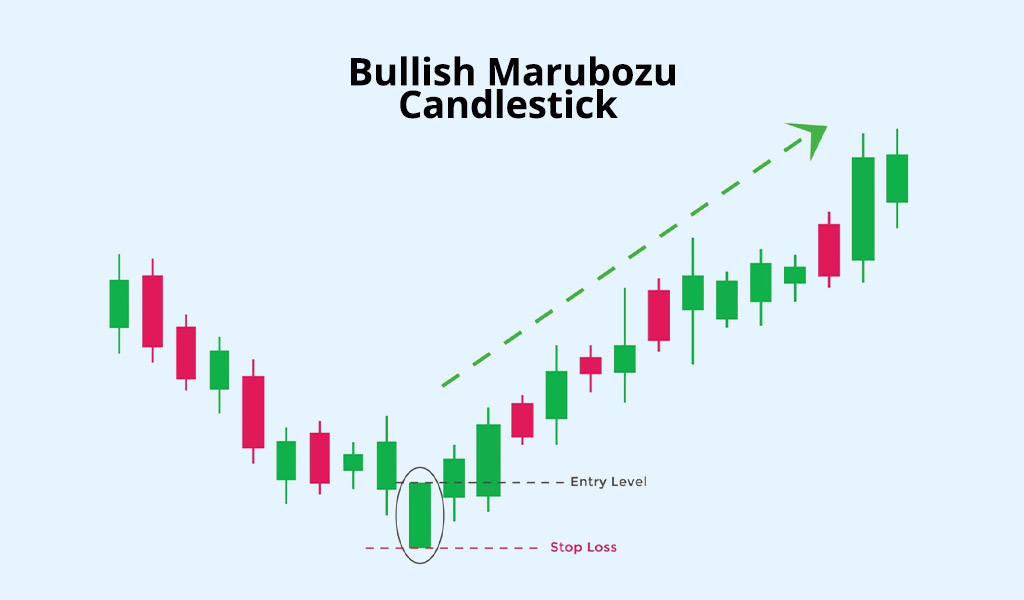

Bullish Marubozu Strategy

- Identify a bullish Marubozu near support or breakout level

- Enter Buy above the candle high

- Stop Loss below the candle low

- Target next resistance or use risk-reward 1:2 or higher

Bearish Marubozu Strategy

- Spot a bearish Marubozu near resistance or breakdown

- Enter Sell below the candle low

- Stop Loss above the candle high

- Target next support zone

Pro Tips for Better Accuracy

🔹 Always trade Marubozu with trend direction

🔹 Combine with volume, RSI, Moving Averages

🔹 Avoid trading during low-liquidity sessions

🔹 Higher timeframes (H1, H4, D1) give stronger signals

Would you like a visual example or help with identifying it on a chart? 🚀