What Is Price Action? – Introduction of Price Action Trading

Price Action Trading is a method of financial market analysis that focuses on interpreting the movement of price alone—without the use of technical indicators like MACD, RSI, or moving averages. Instead, traders rely on candlestick patterns, support and resistance levels, and trendlines to make decisions.

🔍 What Is Price Action Trading?

Price action trading is based on the belief that all relevant market information is already reflected in the price, and the best way to understand market sentiment is to observe how price behaves at key levels. It’s widely used in Forex, stocks, and commodity markets.

📈 Common Price Action Trading Strategies & Patterns

- Pin Bar Reversals

- Indicates a sharp rejection of a price level.

- A long wick (tail) and small body; used to predict reversals.

- Inside Bar Breakouts

- A smaller bar inside a previous bar’s range.

- Sign of consolidation; breakout traders look to capitalize on volatility following the pause.

- Support and Resistance Levels

- Horizontal levels where price frequently bounces or reverses.

- Acts as decision zones for traders.

- Breakout Trading

- Entering when price moves strongly above resistance or below support.

- Traders often confirm breakouts with volume or price re-tests.

- Trendline Bounces and Breaks

- Diagonal lines showing rising or falling price support/resistance.

- Used to trade continuation or reversal.

- Fakey Pattern

- A false breakout followed by a sharp reversal.

- Great for catching stop runs and market traps.

📊 Price Action vs. Other Trading Methods

| Method | Description | Tools Used | Strengths | Weaknesses |

|---|---|---|---|---|

| Price Action | Reads price behavior directly from charts | Candlesticks, S/R levels | Clean, real-time, adaptive | Subjective, requires experience |

| Indicator-Based | Uses tools like RSI, MACD, Bollinger Bands | Indicators | Structured signals | Lags price, can clutter charts |

| Algorithmic | Automated trading via coded strategies | Software & bots | Fast execution, emotionless | Needs coding, not flexible |

| Fundamental | Based on economic/news data | Economic reports, earnings | Long-term insights | Slow to react to price movements |

✅ Pros of Price Action Trading

- Minimal tools — clean charts

- Works across markets and timeframes

- Immediate feedback from price behavior

- No lagging indicators

- Teaches strong technical discipline

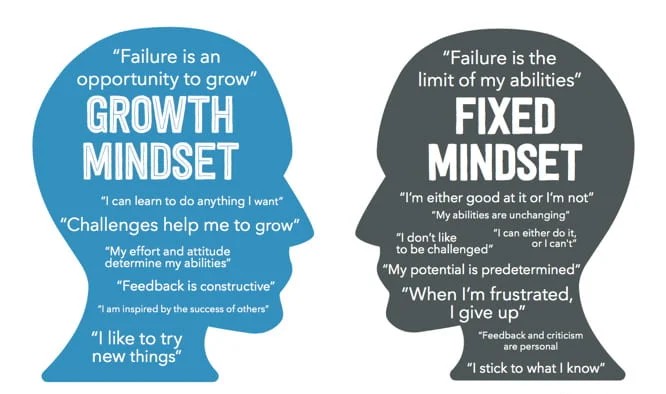

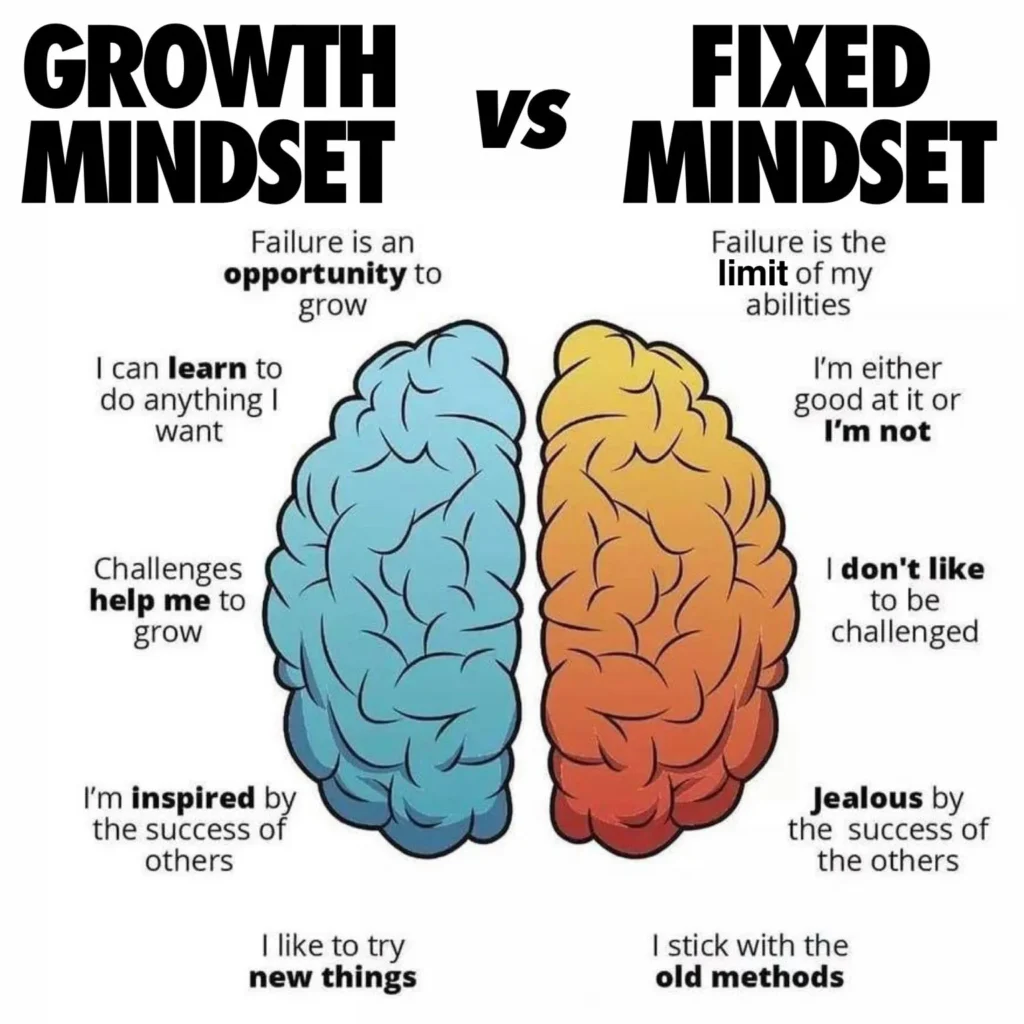

❌ Cons of Price Action Trading

- Subjective interpretation

- Steep learning curve for beginners

- Emotional influence is high

- Requires discipline and screen time

- False signals in choppy markets

📚 Resources to Learn Price Action Trading

Books

- “Trading Price Action” Series – Al Brooks

- “Japanese Candlestick Charting Techniques” – Steve Nison

- “Forex Price Action Scalping” – Bob Volman

- “A Complete Guide to Volume Price Analysis” – Anna Coulling

Courses

- Rayner Teo – Free and paid lessons

- Nial Fuller – Price Action Trading Mastery

- Al Brooks – Brooks Trading Course

- Udemy – Various beginner to advanced classes

Communities & Platforms

- TradingView – See real-time price action ideas

- BabyPips.com – Great for Forex beginners

- Reddit – r/Forex, r/DayTrading

- Discord & Telegram groups – active price-action channels

💡 Final Tip for Beginners:

Start by focusing on one or two setups (like pin bars or support/resistance bounces), use a demo account to practice, and keep a trading journal to track patterns and improve decision-making.