The Three Inside Down is a bearish reversal candlestick pattern that typically forms at the top of an uptrend. It indicates a shift in momentum from bullish to bearish and warns of a potential trend reversal to the downside.

🕯️ Structure of the Three Inside Down Pattern

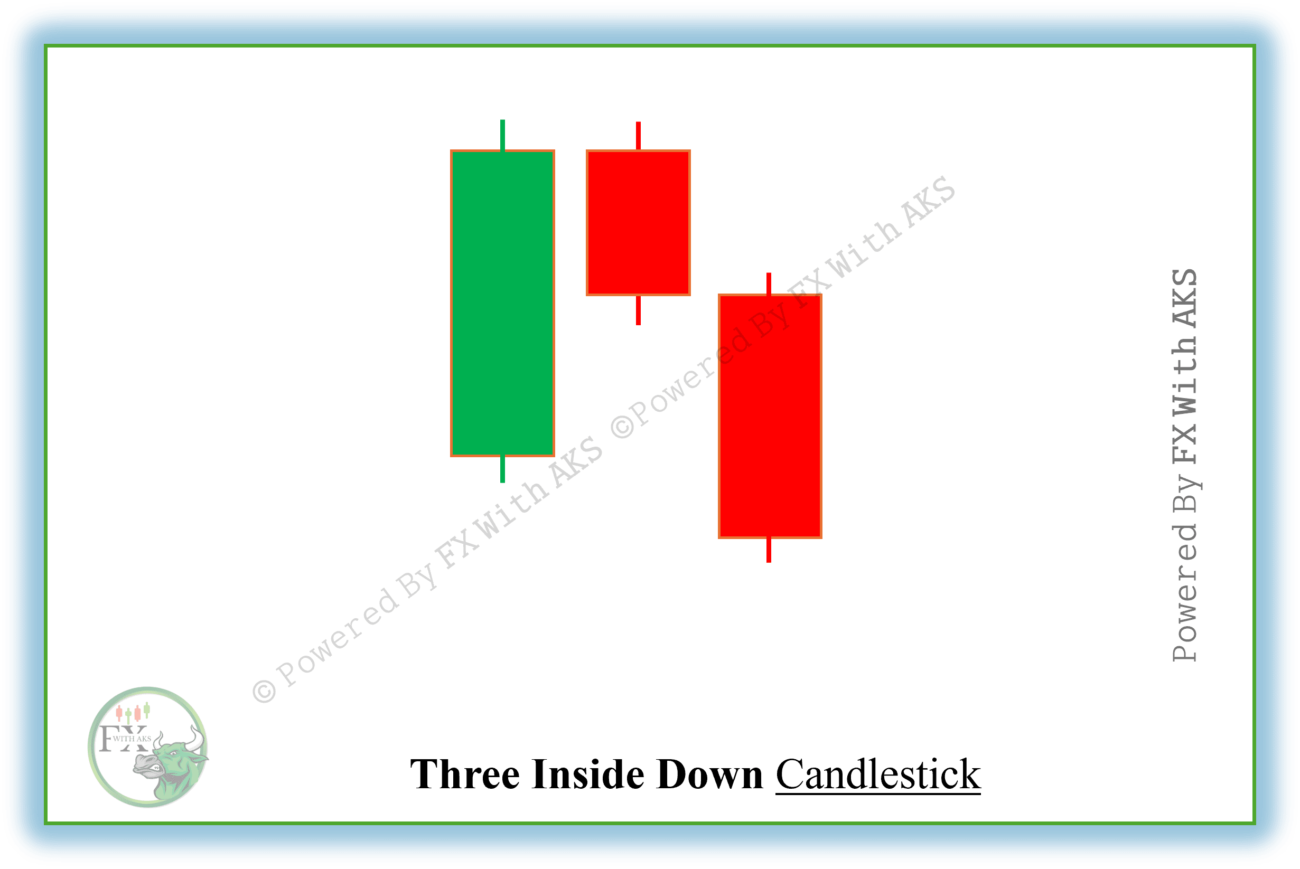

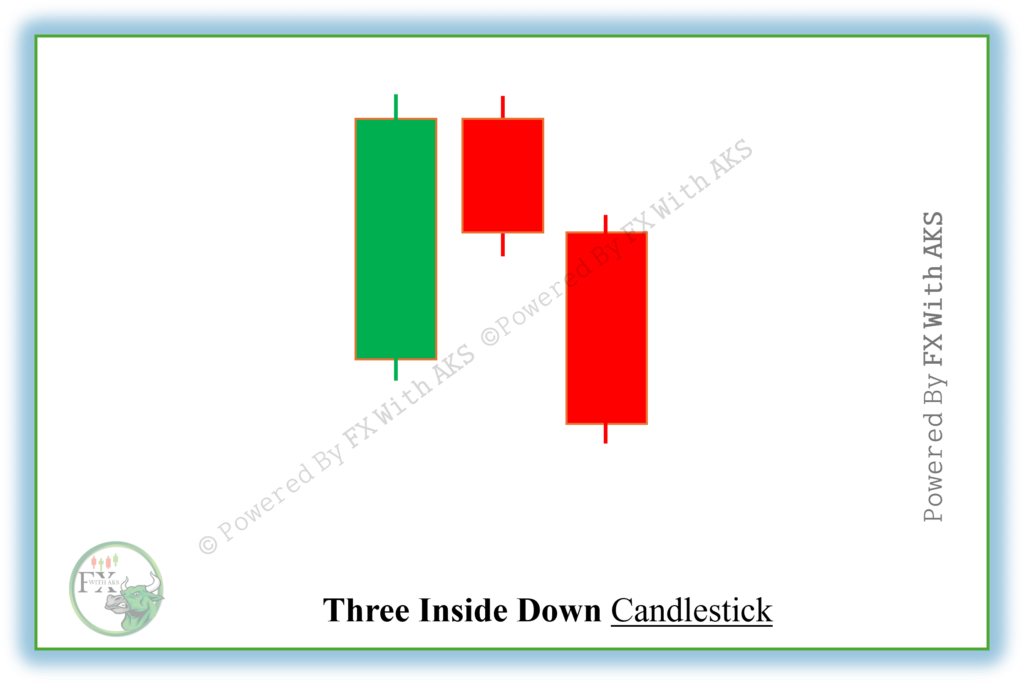

It consists of three candles:

- First Candle:

- A long bullish (green/white) candle.

- Confirms the ongoing uptrend.

- Second Candle:

- A small bearish (red/black) candle.

- Opens and closes within the body of the first candle (an inside bar).

- Forms a Harami pattern (a potential reversal signal on its own).

- Third Candle:

- A strong bearish candle.

- Closes below the close of the second candle, ideally below the low of the first candle.

- Confirms the bearish reversal.

▲ ← Strong Bullish Candle

▼ ← Small Bearish Candle (inside previous)

▼ ← Large Bearish Candle (closes below both)

📉 Interpretation

- First candle: bulls are still in control.

- Second candle: momentum slows; indecision or early selling pressure appears.

- Third candle: sellers take over and confirm that a downtrend may begin.

✅ Confirmation Factors

- Appears after a clear uptrend.

- Third candle closes decisively lower.

- Better confirmation if accompanied by:

- High volume on the third candle.

- Resistance level rejection.

- Bearish divergence on RSI/MACD.

🔁 Related Pattern

| Pattern | Signal | Opposite Pattern |

|---|---|---|

| Three Inside Down | Bearish | Three Inside Up (Bullish) |

⚠️ Pro Tip

- Don’t trade based on this pattern alone. Combine it with other technical indicators, support/resistance analysis, or volume confirmation for higher probability setups.

Would you like to see this pattern on a real chart or use a script to detect it automatically in historical data?