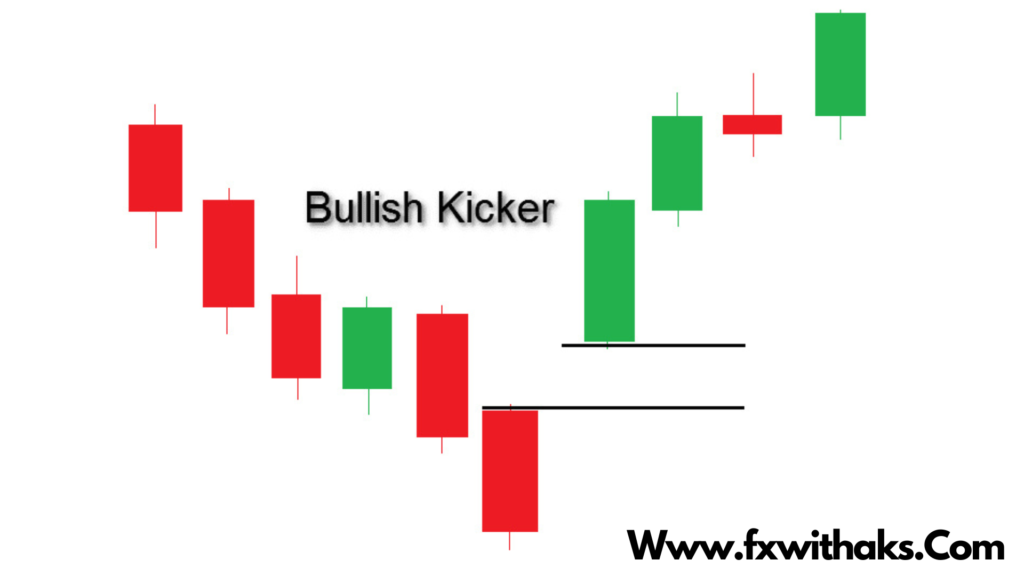

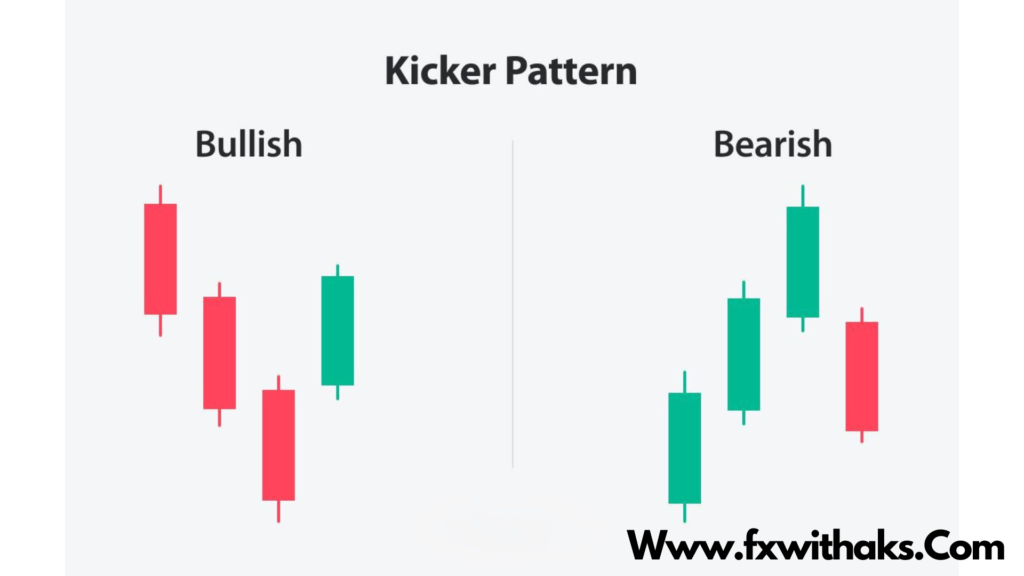

The Bullish Kicker Candlestick is one of the most powerful bullish reversal patterns in candlestick charting. It represents a sudden and aggressive shift in sentiment from bearish to bullish — often caused by unexpected news, earnings, or strong buying momentum.

📌 What It Looks Like

It’s a two-candle pattern:

- First Candle: A big red (bearish) candle.

- Second Candle: A big green (bullish) candle that:

- Opens at or above the previous open, creating a gap up.

- Ignores the previous candle completely and surges higher.

- No overlap between the two candle bodies = strong signal.

🔍 Visual Representation:

Day 1: ████▌ (Bearish candle)

Day 2: ▐████ (Bullish candle with a gap up)

🧠 What It Means

- Day 1: Sellers are fully in control.

- Day 2: The market gaps up and bulls dominate, completely erasing bearish pressure.

- This “kick” in momentum shows strong conviction — typically institutions or big money stepping in.

✅ Bullish Kicker Checklist

| Requirement | Explanation |

|---|---|

| ❗ Strong red candle | Big bearish candle on day one |

| 🚀 Gap up open | Second candle opens above day one’s open |

| ✅ Big green candle | Closes much higher, showing strong buying |

| 🔥 No overlap | Bodies of the candles don’t overlap |

| 🔊 High volume | (Optional) But adds credibility |

📈 Trading Strategy

1. Identify the Pattern

- Spot the red candle followed by a gap-up green candle.

- Ideally on daily or weekly timeframes for higher reliability.

2. Enter the Trade

- Option A: Enter at the close of the green candle (once it forms).

- Option B: Enter on the next candle if it breaks the high of the bullish kicker.

3. Set Stop-Loss

- Just below the low of the green candle (or the red candle if you want a wider stop).

4. Set Profit Target

- Target previous resistance, swing highs, or use a 2:1 or 3:1 risk/reward ratio.

🧠 Pro Tips

- Combine with volume or support zones for stronger signals.

- Best used when it appears at major bottoms or after downtrends.

- Use with other indicators (like RSI or MACD) to build confluence.

Want me to generate a sample chart with a Bullish Kicker? Or a cheat sheet with entries/stops/targets?

Trading the Bullish Kicker Candlestick is all about recognizing the sudden momentum shift and jumping in smartly with proper risk management. Here’s a step-by-step guide to trading it like a pro:

🚀 How to Trade the Bullish Kicker Candlestick

🔍 Step 1: Spot the Pattern

- Look for a strong bearish (red) candle followed by a large bullish (green) candle.

- The green candle should gap up and open at or above the previous open, with no overlap between the two bodies.

📌 This shows a clear shift in market sentiment — buyers are now fully in control.

✅ Step 2: Confirm the Signal

- Confirm the second candle closes strong (near its high).

- Optional but helpful: Check for increased volume on the bullish candle.

- Use other tools like support zones, RSI divergence, or MACD crossover to increase your confidence.

💼 Step 3: Enter the Trade

Two entry options:

- Conservative Entry: Wait for the next candle to break above the high of the bullish kicker.

- Aggressive Entry: Enter at the close of the kicker candle if it’s strong and confirms the reversal.

🛡️ Step 4: Set Your Stop-Loss

- Place stop-loss below the low of the bullish kicker candle (safe).

- More conservative: Below the low of the bearish candle (gives more room).

🎯 Step 5: Take-Profit Strategy

Choose one of these:

- 📈 Target Resistance: Set your take-profit at the next resistance level.

- 🎯 Risk/Reward Ratio: Use a 2:1 or 3:1 ratio (e.g., risk 1% to make 2-3%).

- 🌀 Trailing Stop: If the trend is strong, trail your stop to ride the move longer.

🔑 Example Trade Setup

| Element | Value |

|---|---|

| Timeframe | Daily chart |

| Pattern | Bullish Kicker after downtrend |

| Entry | Break of kicker candle high |

| Stop-Loss | Below kicker candle low |

| Target | Next resistance / 2:1 R:R |

📌 Pro Tips

- Use higher timeframes (like daily) for more reliable signals.

- Combine with indicators like volume, RSI, trendlines.

- Avoid trading it in choppy or sideways markets.

Would you like a visual chart example of a Bullish Kicker setup? Or a quick cheat sheet you can save? Comment Must