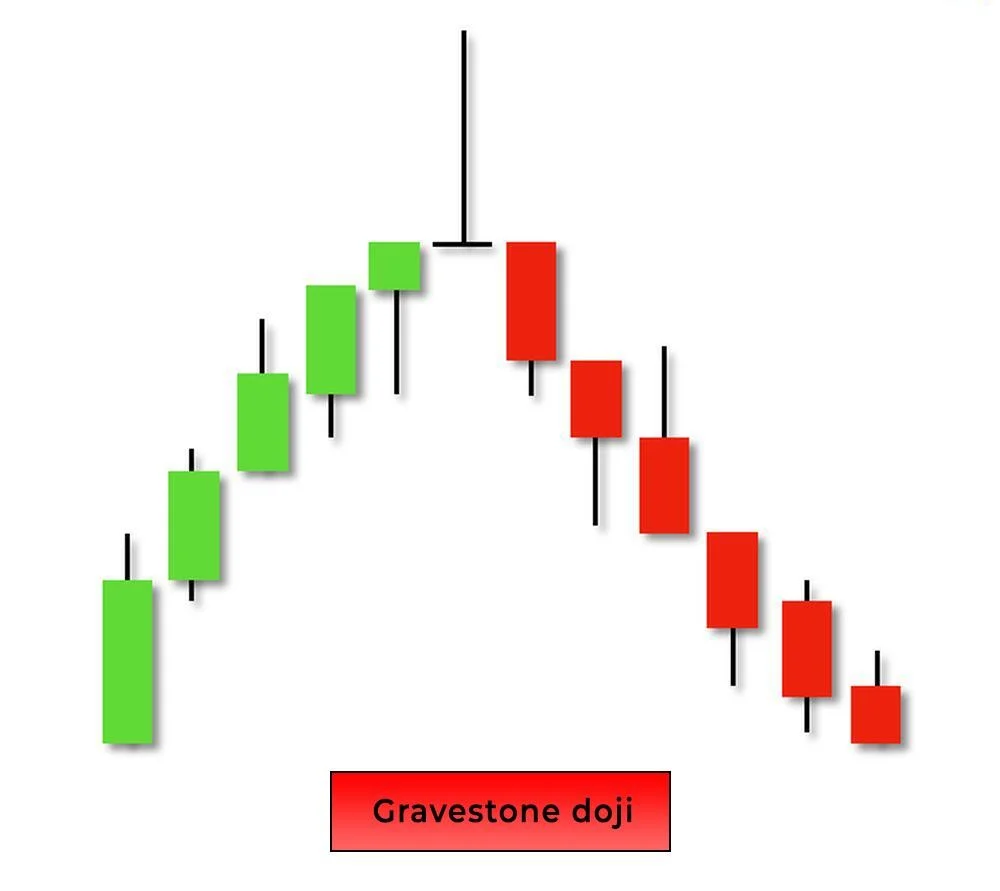

The Gravestone Doji is a bearish reversal candlestick pattern that typically appears at the top of an uptrend. It represents a strong rejection of higher prices, and suggests that buyers lost control, giving way to potential downward movement.

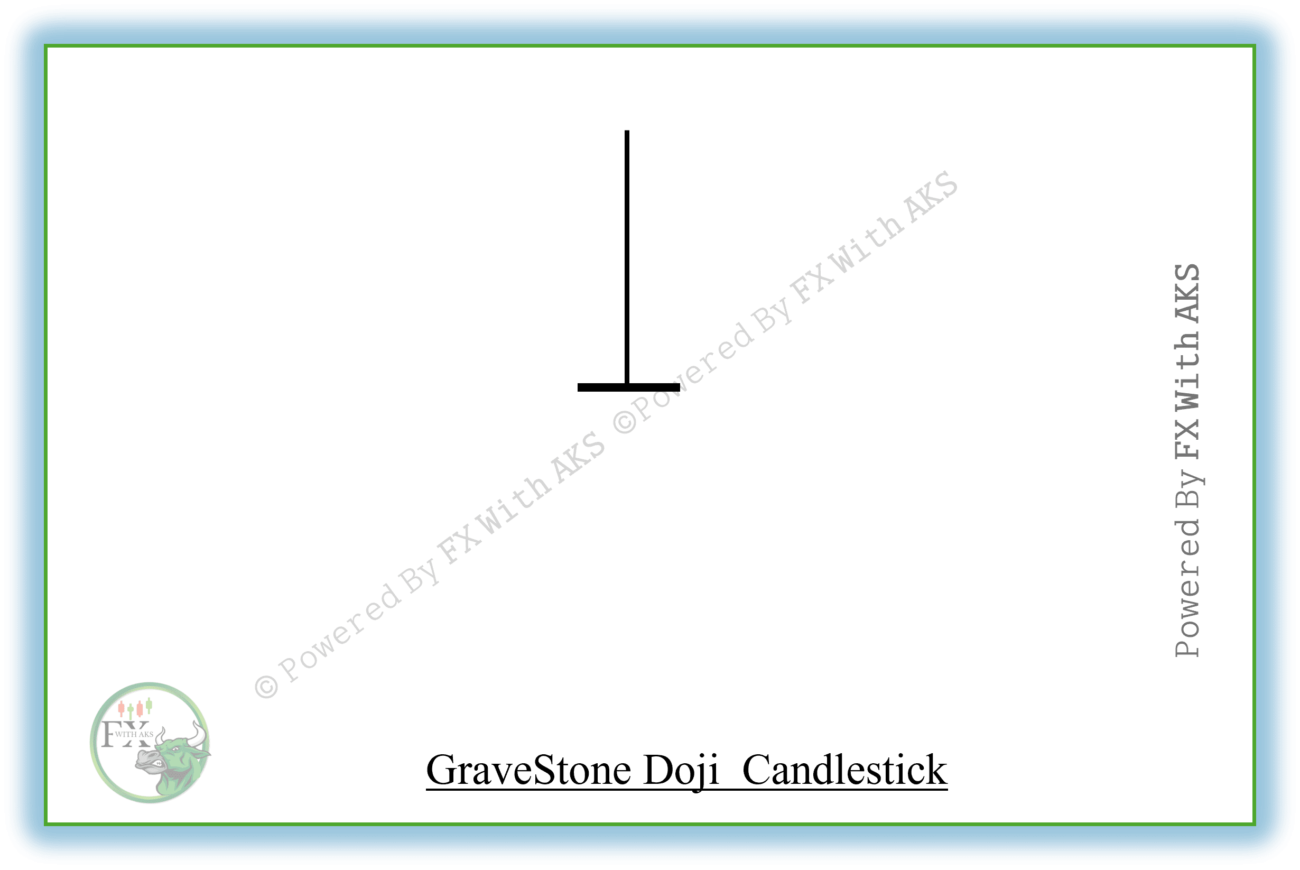

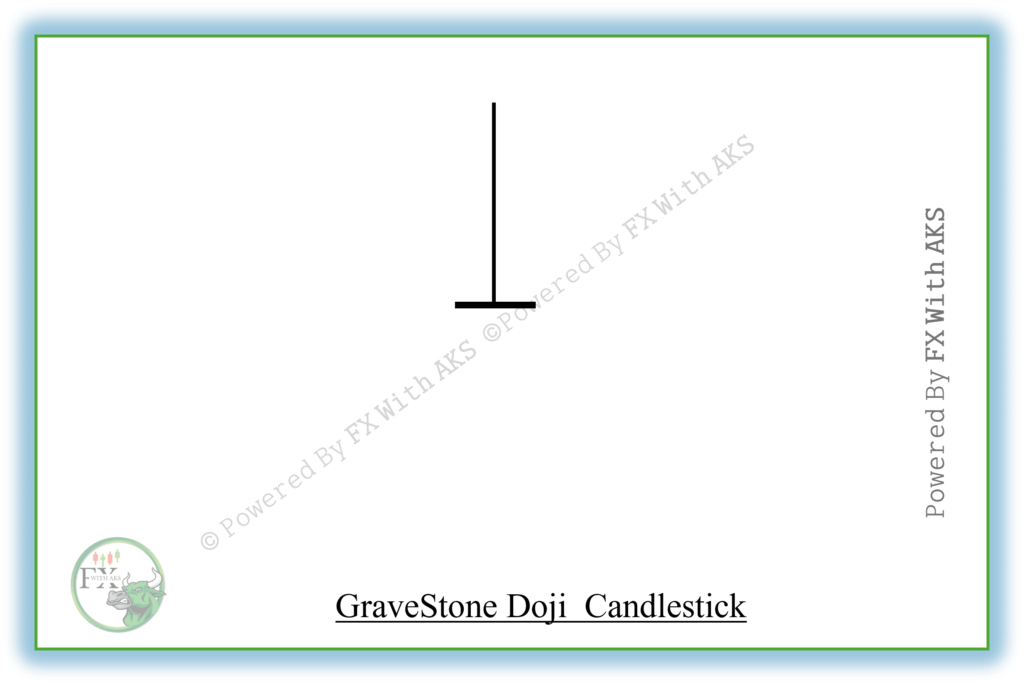

🕯️ Structure of a Gravestone Doji

- Open, Low, and Close prices are virtually the same.

- Long upper shadow (wick) — price went much higher during the session, but couldn’t hold.

- No or very little lower shadow.

High

│

───────

● ← Open = Close = Low

This shape resembles a gravestone, hence the name — symbolizing the possible “death” of the uptrend.

📉 Interpretation

- The market opens, rallies strongly, but sellers take over and push the price back to the open/low.

- This shows complete rejection of bullish pressure.

- Often signals the top of a rally or resistance level rejection.

✅ Stronger Signal When:

- Occurs after a strong uptrend.

- Followed by a bearish confirmation candle (e.g., strong red close).

- Accompanied by high volume, indicating distribution.

- Appears near resistance levels or overbought zones (e.g., RSI > 70).

🔁 Comparison with Similar Candles

| Pattern | Trend | Signal | Key Feature |

|---|---|---|---|

| Gravestone Doji | Up | Bearish | Doji with long upper wick |

| Shooting Star | Up | Bearish | Small body + long upper wick |

| Dragonfly Doji | Down | Bullish | Long lower wick, no upper |

⚠️ Pro Tip

- The Gravestone Doji alone isn’t a trade signal — wait for confirmation on the next candle.

- Use in combination with tools like resistance lines, volume spikes, or divergence indicators for more reliable setups.

Would you like to see this pattern on a chart, or get code to detect it in TradingView or Python?