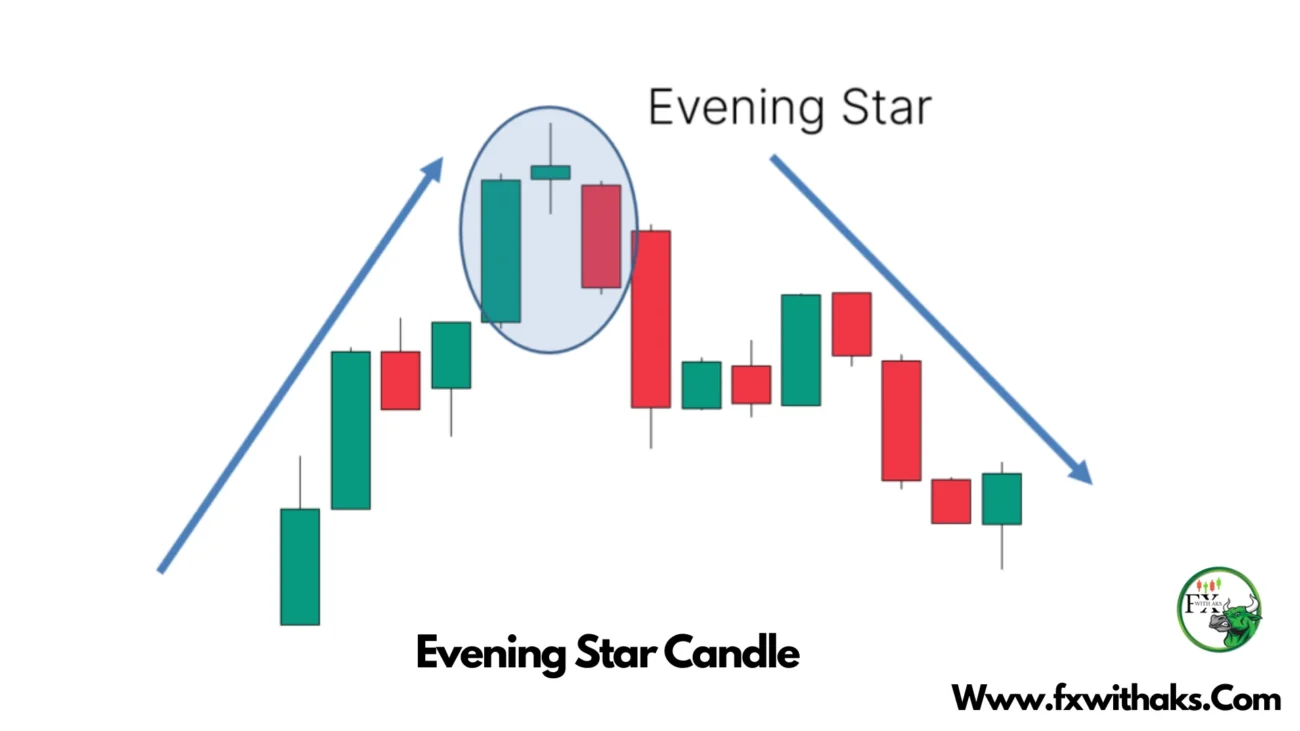

The Evening Star is a classic bearish reversal candlestick pattern that typically appears at the top of an uptrend. It signals that buying momentum is slowing and a potential downtrend may follow.

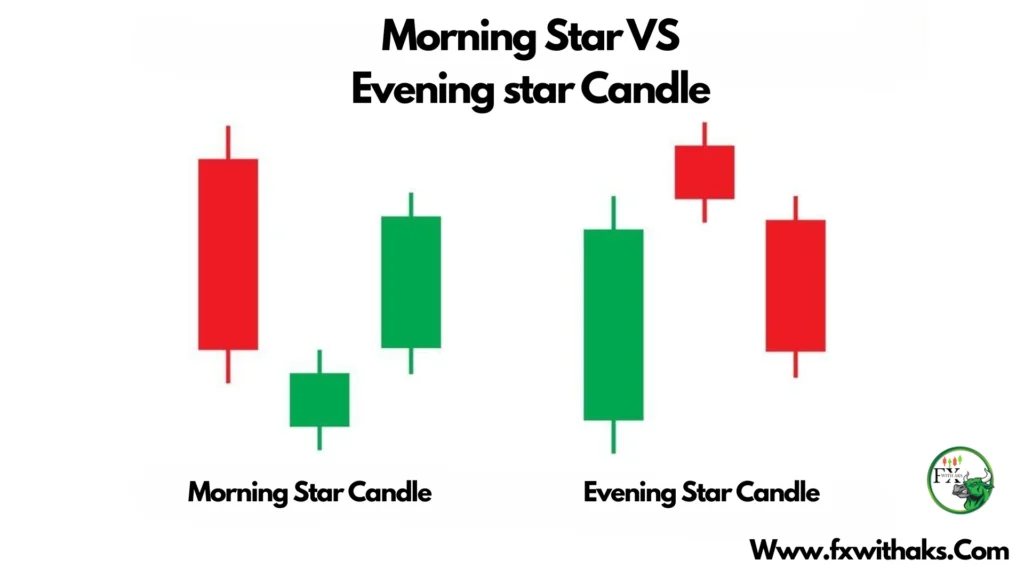

Morning Star VS Evening Star Candle

🌇 Evening Star Pattern Breakdown

It’s a three-candle formation:

- First Candle – Strong bullish (green) candle, continuing the uptrend.

- Second Candle – Small-bodied candle (can be bullish or bearish), showing indecision. This forms the “star” and may gap up from the first.

- Third Candle – Strong bearish (red) candle that closes deep into the body of the first candle, confirming the reversal.

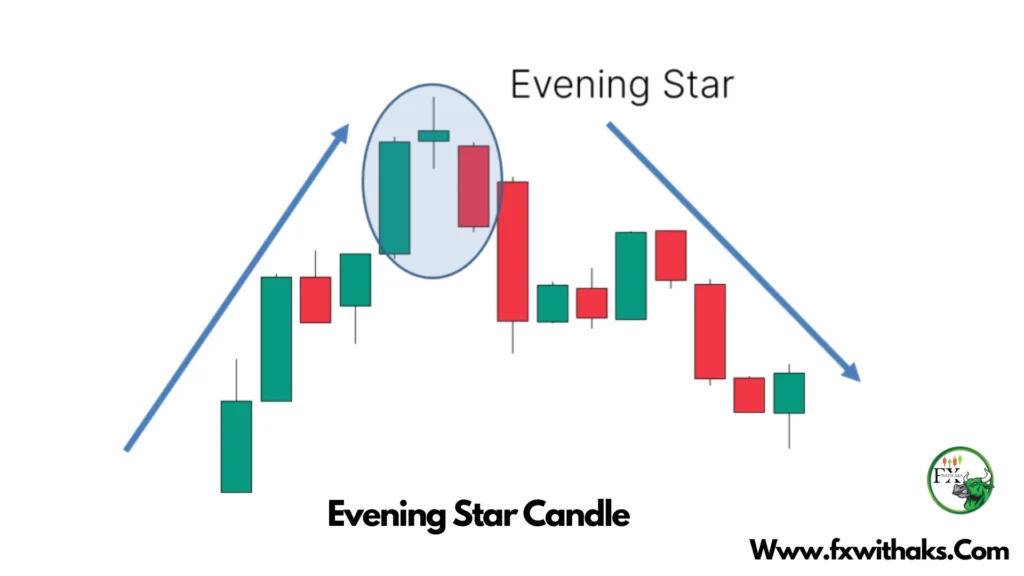

📉 What It Tells You

- The bulls are losing strength.

- The second candle shows hesitation (market is undecided).

- The third candle confirms that bears are now in control.

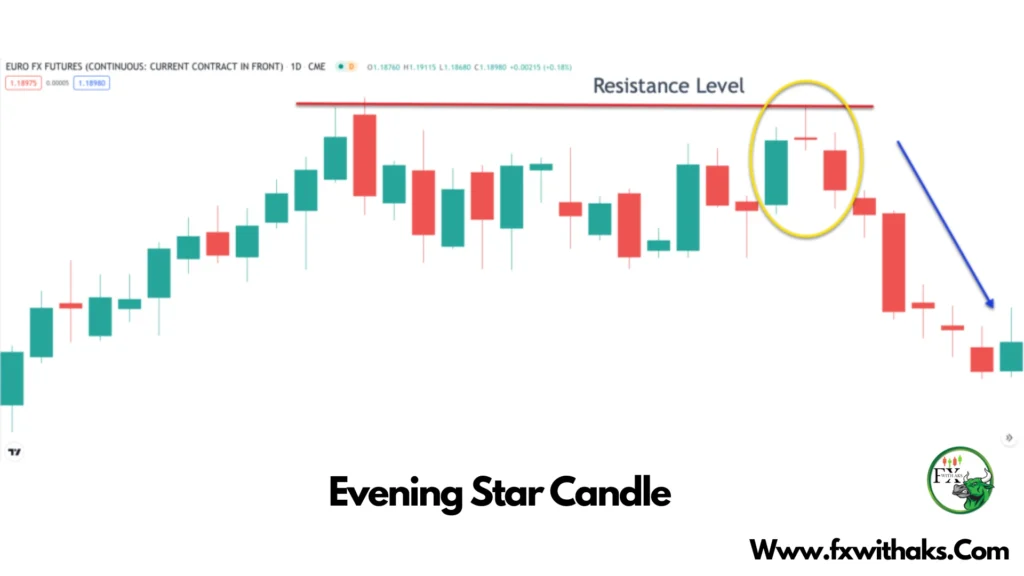

✅ Ideal Use

- Use it to exit long positions or enter short trades.

- Works best when confirmed with:

- Resistance level

- High volume on the third candle

- Indicators like RSI showing overbought

Use of Evening Star Candle

The Evening Star candlestick pattern is used by traders to identify potential bearish reversals and make decisions about entering, exiting, or managing trades. Here’s how and when to use it:

✅ 1. Spot Bearish Reversal Opportunities

- Use it after an uptrend to signal that the upward momentum is weakening.

- The pattern often appears near resistance zones or overbought conditions.

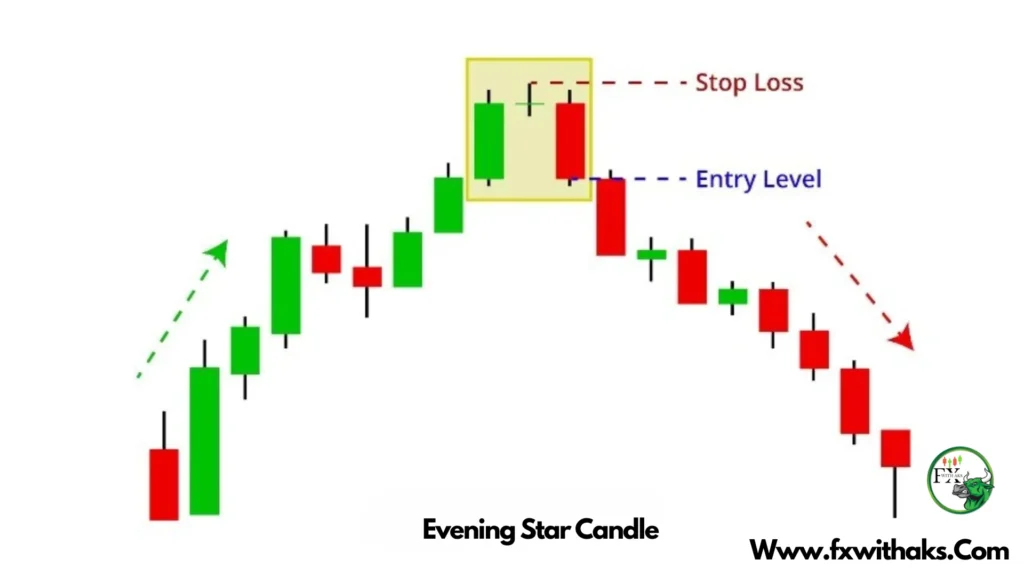

💼 2. Trade Decisions You Can Make

| Action | How to Use |

|---|---|

| Exit Long Trades | If you’re already in a buy (long) position, the Evening Star is a sign to take profits before a downturn. |

| Enter Short Trades | Enter a sell (short) position after the third candle confirms the reversal. |

| Set Stop-Loss | Place it above the high of the Evening Star formation for risk control. |

📊 3. Combine With Confirmation

- Indicators: Use RSI (look for overbought), MACD (look for bearish cross), or volume (higher volume on the third candle is stronger).

- Support/Resistance: Pattern is stronger near key resistance levels.

- Follow-Up Candle: A bearish candle following the pattern further confirms the move.

🔁 Example Setup

- Uptrend is in place

- Evening Star pattern appears

- RSI shows overbought

- Enter short at the open of the next candle

- Place stop-loss above the Evening Star’s high

- Set take-profit near recent support

Want a chart example or a trading strategy template using this pattern?

One thought on “Evening Star Candle – Definition , How To Trade”