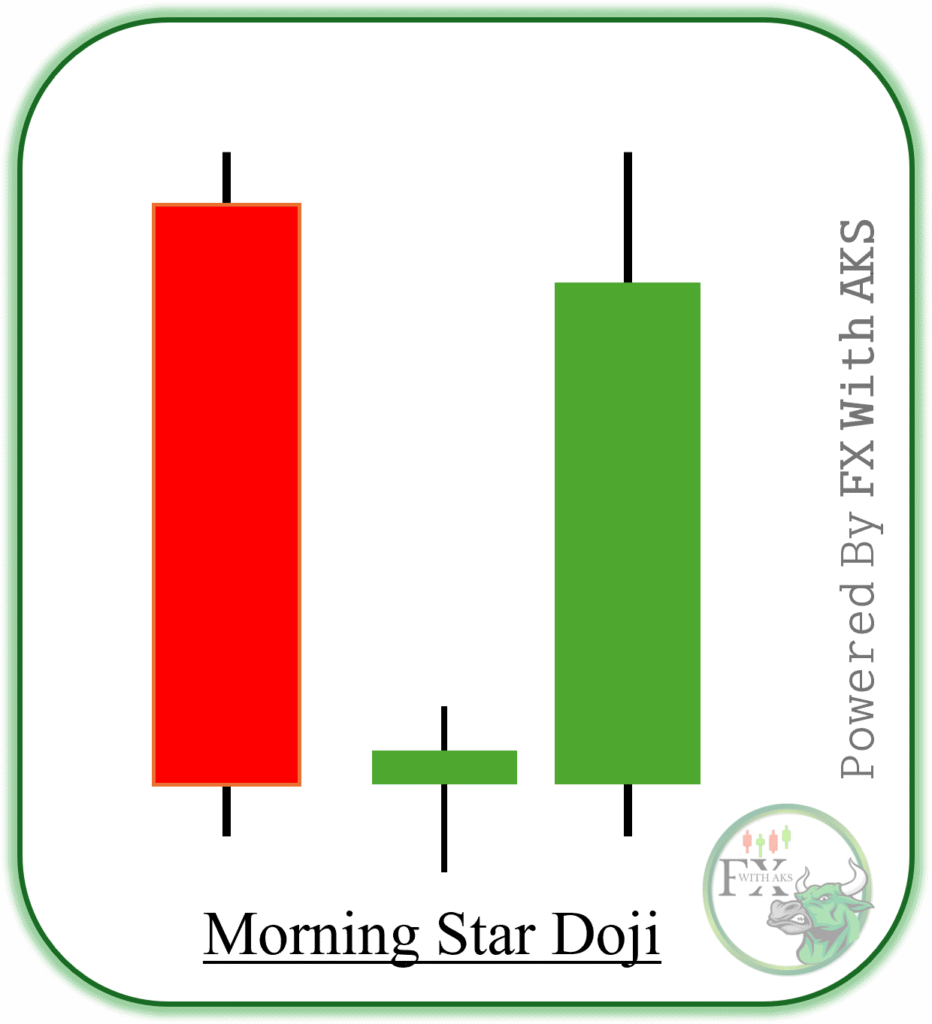

The Morning Star Doji is a powerful bullish reversal candlestick pattern that typically appears at the bottom of a downtrend. It signals a potential shift from bearish to bullish sentiment and is a variation of the standard Morning Star pattern, with the middle candle being a Doji (showing indecision).

🧱 Structure of Morning Star Doji Pattern

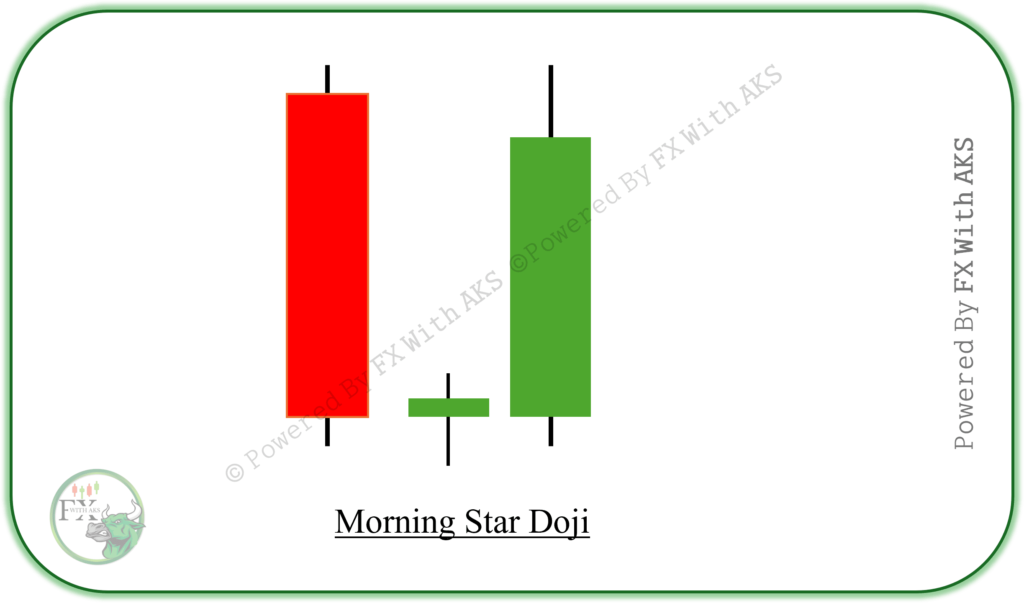

It is a three-candle formation:

- First Candle – Large bearish (red) candle

🔻 Indicates strong selling pressure - Second Candle – Doji

➖ Open and close are nearly the same, showing market indecision

➖ Sellers are losing momentum - Third Candle – Large bullish (green) candle

🔼 Confirms reversal; buyers step in strongly

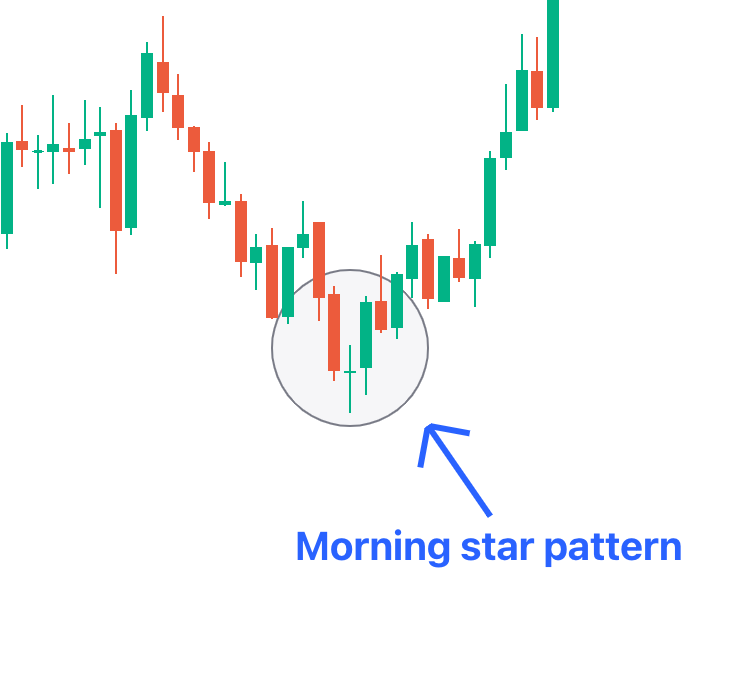

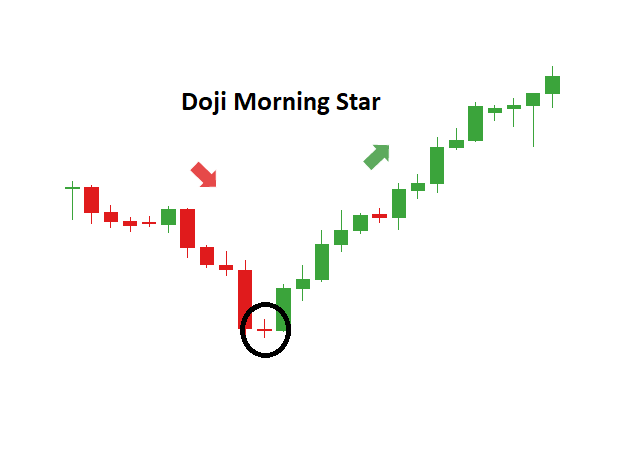

📊 Chart Context

- Appears after a downtrend

- Works best near support levels

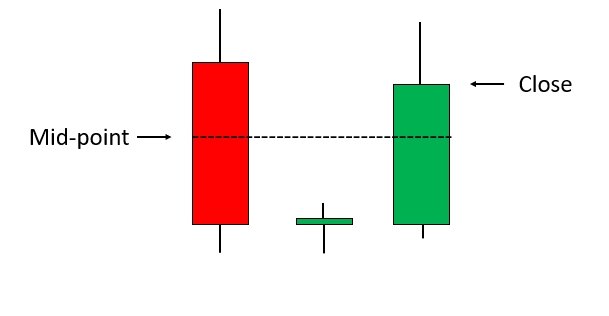

- Confirms when the third candle closes above the midpoint of the first candle

✔️ How to Trade Morning Star Doji

Entry:

- Enter a buy (long) trade at the close of the third candle

- Alternatively, wait for a break above the high of the third candle for confirmation

Stop-Loss:

- Below the low of the Doji (second candle) or entire pattern

Take-Profit (TP):

- Use nearby resistance levels or previous swing highs as TP targets

✅ Tips for Higher Accuracy

- Combine with volume spike on third candle

- Look for confirmation from RSI divergence or oversold condition

- Use on higher timeframes (H1, H4, D1) for stronger signals

Would you like:

- A diagram showing a Morning Star Doji pattern?

- A real chart example annotated?

- This explanation added to the PDF guide?

Let me know what you’d prefer!